NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

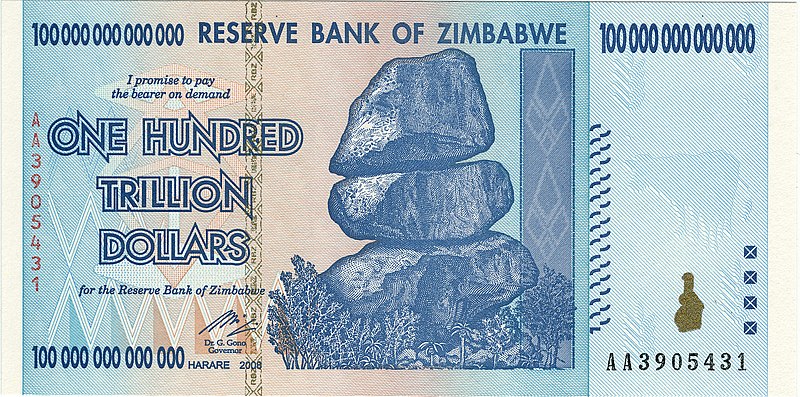

... until the $1,000,000,000,000 coin idea was proposed.Actually, we all have heard from both, as they continue to be the two largest purchasers of our Treasury debt. If risk is reflected in the interest rates as economic theory suggests, they both think the US debt is the safest around...