schenbew

Recycles dryer sheets

I found this article very interesting, and think many members of this site qualify as "Mini-Millionaires" as the WSJ defines it.

An unlocked link to the article is here: https://www.wsj.com/us-news/never-m...fsw4oph4sry&reflink=desktopwebshare_permalink

I think the following quote, if accurate, is quite positive and MAY portend a slow reversal of the wealth gap that has steadily built up since the 1980s:

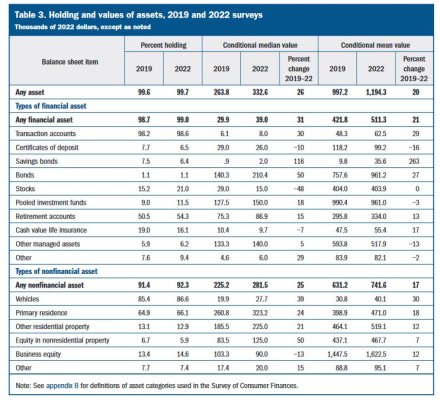

"Rather than being left behind as all the gains in the economy accrue to billionaires, they have in fact seen bigger wealth gains over the past three years than the top 10% of families. Indeed, the biggest wealth gains between 2019 and 2022 were among the approximately 13 million families in the 80th to 90th percentile of the income distribution. Their median wealth jumped 69% from 2019, adjusted for inflation, to $747,000 in 2022."

An unlocked link to the article is here: https://www.wsj.com/us-news/never-m...fsw4oph4sry&reflink=desktopwebshare_permalink

I think the following quote, if accurate, is quite positive and MAY portend a slow reversal of the wealth gap that has steadily built up since the 1980s:

"Rather than being left behind as all the gains in the economy accrue to billionaires, they have in fact seen bigger wealth gains over the past three years than the top 10% of families. Indeed, the biggest wealth gains between 2019 and 2022 were among the approximately 13 million families in the 80th to 90th percentile of the income distribution. Their median wealth jumped 69% from 2019, adjusted for inflation, to $747,000 in 2022."