chinaco

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 14, 2007

- Messages

- 5,072

What do you think about the prospect for the Health Care sector?

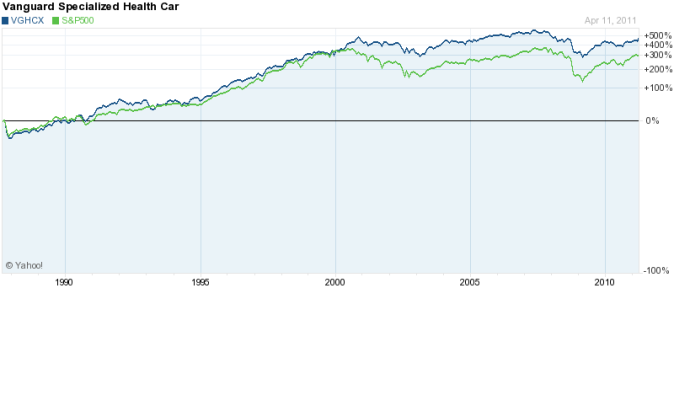

VG health care sector fund has done pretty well since its inception in 1984.

Our health care seem to be in a state of change in terms of policy which might cause of uncertainty about winners and losers.

But there is little doubt that there will be an increase in consumption.

Good or Bad investment?? Over the short, medium, and long term?

VG health care sector fund has done pretty well since its inception in 1984.

Our health care seem to be in a state of change in terms of policy which might cause of uncertainty about winners and losers.

But there is little doubt that there will be an increase in consumption.

Good or Bad investment?? Over the short, medium, and long term?