There was a thread recently (something about a derivative exchange) where I made a disparaging comment on being classified an "accredited investor" is nothing more than an invitation to attempt to scam you.

You need that distinction to invest in hedge funds which receive lots of hype. Many years ago I was solicited to buy into one and the sales pitch was based on now that I have achieved "accredited investor" status I could invest like the rich people do. So if I didn't invest in the hedge fund, I was being stupid. I never invested and never bothered to see how the fund did.

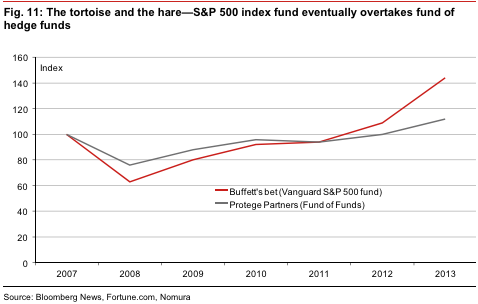

Warren made a bet with a hedge fund. Here's the link for anyone considering investing in a hedge fund.

Buffett's index fund outgains hedge funds in 10-year bet

You need that distinction to invest in hedge funds which receive lots of hype. Many years ago I was solicited to buy into one and the sales pitch was based on now that I have achieved "accredited investor" status I could invest like the rich people do. So if I didn't invest in the hedge fund, I was being stupid. I never invested and never bothered to see how the fund did.

Warren made a bet with a hedge fund. Here's the link for anyone considering investing in a hedge fund.

Buffett's index fund outgains hedge funds in 10-year bet