I read thru this thread yesterday after stumbling on it again. Lots of interesting points and perspectives given.... a pretty good discussion overall.

Over time I have gone from preferring dividend funds to sector funds, to VOOG and finally to VTI for my primary equity fund. But every few months I revisit the idea of using a dividend fund as part of an income portfolio and usually leave things alone because of the current tight correlation between all the US based vanguard equity funds to SPX. Some have larger drops but also have large jumps and for the most part move together no matter what.

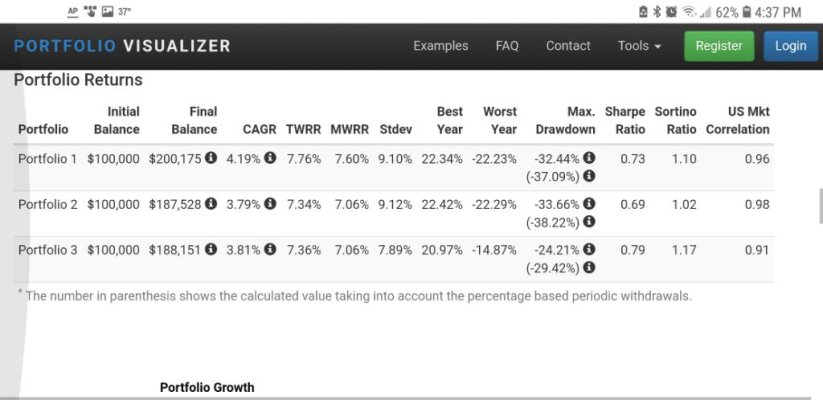

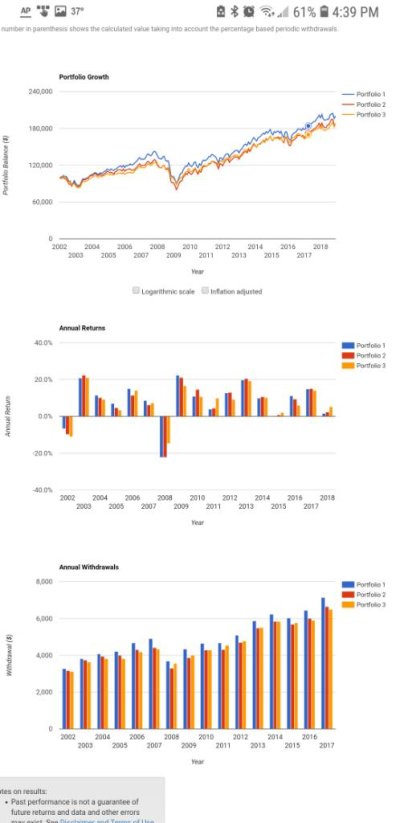

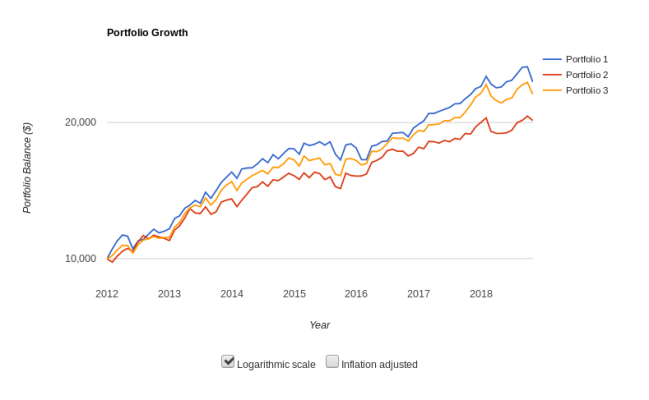

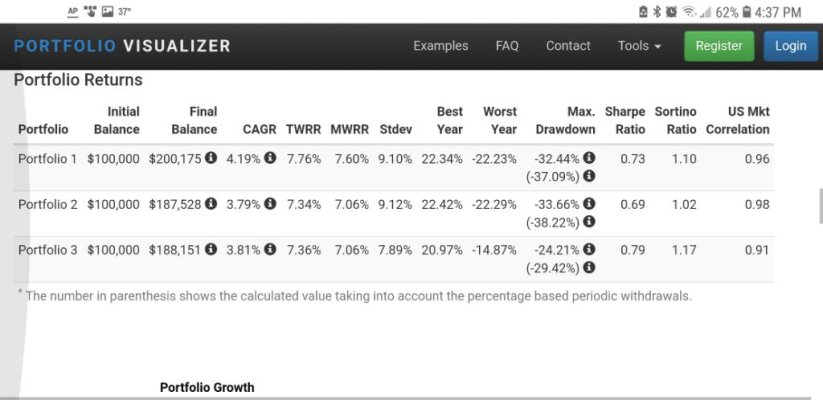

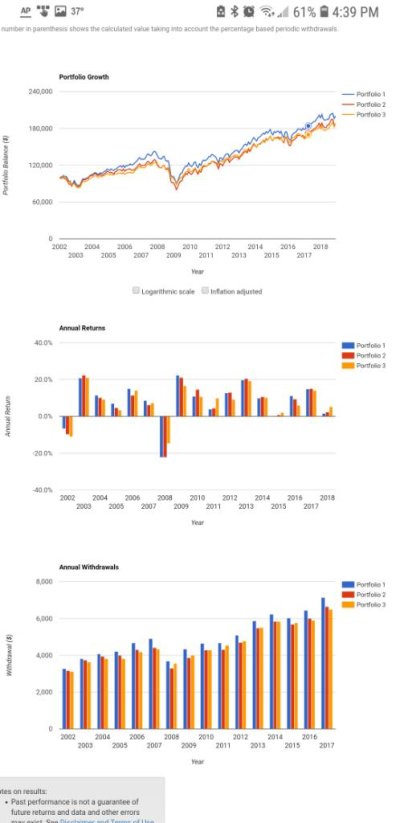

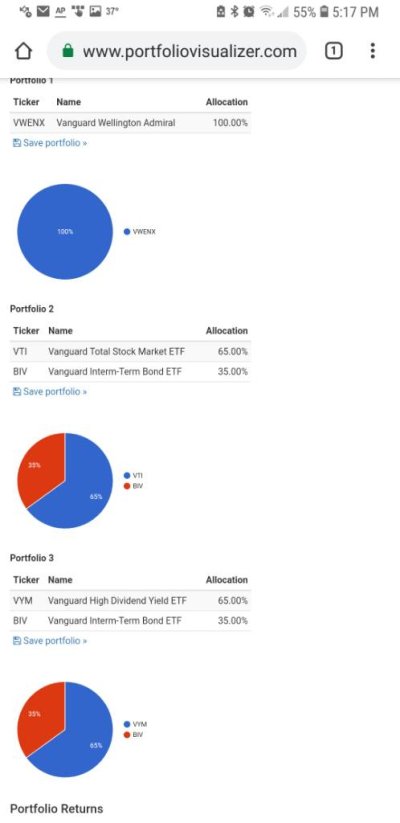

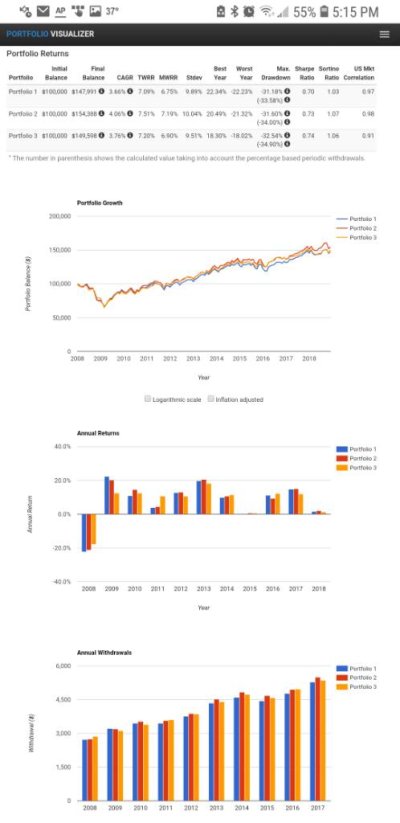

After reading this thread again I played with Portfolio visualizer with these three portfolios to test the differences.

In all cases, started with $100,000 beginning in 2001 (that is when the inception date for the intermediate bond fund I used). I used VWENX as a baseline for a 65/35 portfolio aimed at income with some growth.

3.5% distribution annually, and rebalance annually.

Port 1: VWENX. 100%

Port 2: VTSAX 65% / VBILX 35%

Port 3: VDIGX 65% / VBILX 35%

I used mutual funds instead of their ETF equivalent because the MFs are older. I also wanted to use VYM because that would be my choice for an income focused dividend ETF but it and its MF equivalent only goes back to 2006.

The results are very close and surprised my a little.