- Joined

- Oct 13, 2010

- Messages

- 10,735

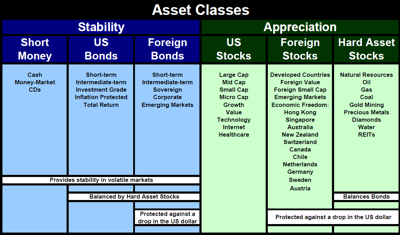

Many U.S. investors crowd their assets into a combination of large-cap U.S. stocks and U.S. bonds. This allocation represents only one and a half of the six asset classes described here.

Asset allocation means always having something to complain about.

Source: http://www.marottaonmoney.com/invest-in-all-six-asset-classes/

Last edited: