Ed_The_Gypsy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

How To Survive a 'Zombie Economy' - Rick Newman (usnews.com)

Nothing new, just keep your head down and your powder dry.

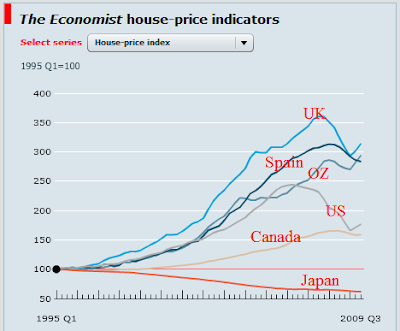

But there are ways to ride the zombie, and Japan has shown us how. With interest rates painfully low and stocks volatile, investors should look for dividend-paying stocks and high-quality bonds. Consumers should keep paying down debt and resist any additional debt if possible. Tempting as it might be to replace an aging car or out-of-style appliance, it's okay to wait. Prices are unlikely to rise by much, and might even fall. Home prices in particular seem likely to keep falling, at least into 2011. And lenders might become more permissive over the next year or two, as they slowly improve their own financial health.

Job seekers should develop every new skill they can, since employers these days are looking for people with two or even three distinct skill sets. Even if the U.S. experience amounts to Japan Lite, the job market will stay tough. People need to go where the jobs are and prove why they're worth investing in during slack times. It doesn't hurt to have a secondary source of income, since raises are likely to be scarce.

Nothing new, just keep your head down and your powder dry.