ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

𝄆 Keep it Simple. 𝄇

𝄆 Keep it Simple. 𝄇

50-50, 60-40? - you are over-thinking this.

𝄆 Keep it Simple. 𝄇

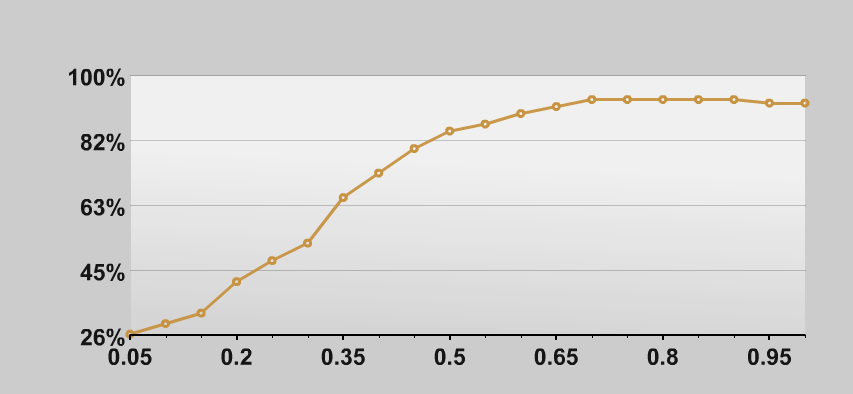

If I followed your numbers right, you have ~ $785K portfolio, and plan on ~ $30K spend? That is a 3.832% WR. I forget your age, but when I plug that into FIRECALC for a 40 year profile, and hit 'Investigate' to see how various AA's do, see the attached.

Now, given the vagaries of past/future performance, does anything in the range of 60-100% look 'riskier' than 50% AA? It's pretty flat from 60% to 100%, no? If I got the numbers right, what I might be more likely to question is whether a 3.8% WR is too aggressive for ER, regardless of AA.

𝄆 Keep it Simple. 𝄇

Stop it then. You see, no one is suggesting you allocate ANY money to any specific market segment - but you keep using that as an 'excuse' as to why you can't DIY. Just hit the broad market with a broad AA and call it a night.

𝄆 Keep it Simple. 𝄇

-ERD50

I know this is somewhat of a dumb question about AA since it is up to us what we are willing to risk, but staying in that 60-40 ratio is a bit of a classic. ... If I went to 1/3 International, 1/3 Wellesley, 1/3 Wellington that would push me just over 60% stocks wouldn't it? Or would a 50-50 combo be enough to get us what we need with a bit less risk? ....

𝄆 Keep it Simple. 𝄇

50-50, 60-40? - you are over-thinking this.

𝄆 Keep it Simple. 𝄇

If I followed your numbers right, you have ~ $785K portfolio, and plan on ~ $30K spend? That is a 3.832% WR. I forget your age, but when I plug that into FIRECALC for a 40 year profile, and hit 'Investigate' to see how various AA's do, see the attached.

Now, given the vagaries of past/future performance, does anything in the range of 60-100% look 'riskier' than 50% AA? It's pretty flat from 60% to 100%, no? If I got the numbers right, what I might be more likely to question is whether a 3.8% WR is too aggressive for ER, regardless of AA.

𝄆 Keep it Simple. 𝄇

Can't help but doubt myself......I thought Janus Global Tech funds were a good place to be in the late 90's.....ouch.

Stop it then. You see, no one is suggesting you allocate ANY money to any specific market segment - but you keep using that as an 'excuse' as to why you can't DIY. Just hit the broad market with a broad AA and call it a night.

𝄆 Keep it Simple. 𝄇

-ERD50

, and it sounds like you have a better handle on your expense than I gave you credit for. Me bad. The good news is there generally plenty of cushion built into most retirement plans on this forum.

, and it sounds like you have a better handle on your expense than I gave you credit for. Me bad. The good news is there generally plenty of cushion built into most retirement plans on this forum.