Osprey

Recycles dryer sheets

- Joined

- Jul 28, 2016

- Messages

- 144

Forbes Welcome

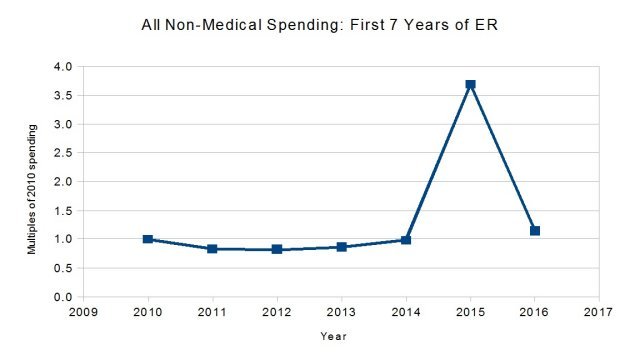

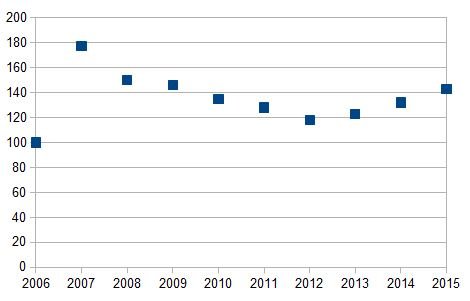

Article raises possibility that a higher withdrawal rate at outset is sustainable since as we age expenses will likely decline for a period before rising due to health care costs.

Sent from my iPad using Early Retirement Forum

Article raises possibility that a higher withdrawal rate at outset is sustainable since as we age expenses will likely decline for a period before rising due to health care costs.

Sent from my iPad using Early Retirement Forum