MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

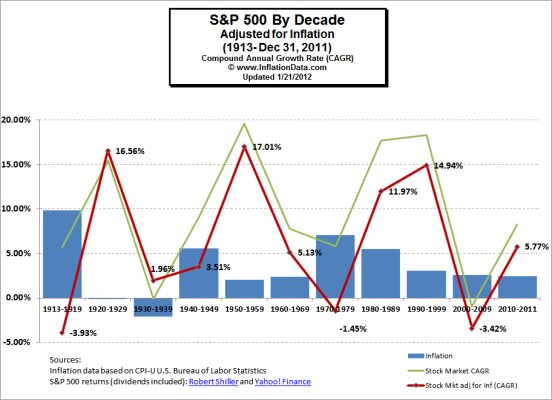

The best argument against anuities is that reasonably priced inflation adjusted annuities are not available, and without this, inflation will kill the value of annuities.

I know this is not mainstream thinking, but bookmark this post and check back in 15 years.

Ha

perhaps bonds fit in that category as well. And stocks are just too risky.

I'm going to go hide under the covers for now.

...

...

.

.