UnrealizedPotential

Thinks s/he gets paid by the post

- Joined

- May 21, 2014

- Messages

- 1,390

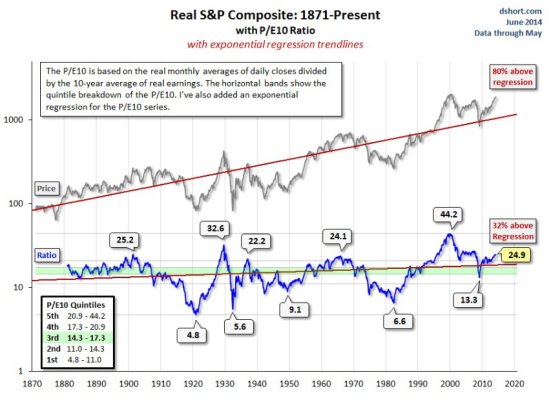

I pose this question because in October of 2011 the S and P 500 hit what was technically a sum total 20% intraday downturn from the previous high ,labeling it a bear market.The Dow and Nasdaq in 2011 fared better,but after the 2008-2009 bear market it seemed overkill to have another sharp drop so soon in time.So if the Bull market didn't really start until after October of 2011 this makes it only roughly 2.75 years old and not 5 years into the Bull market.If this is true,and I am only supposing ,then maybe this helps to explain the lack of a 10% correction.We had a nice 6% correction in the SP500 some months ago and nice correction in biotechs in the Nasdaq earlier this year. If my theory is correct maybe,just maybe this Bull Market is not so long in the tooth as was thought.This doesn't mean we won't have a nice correction at some point soon,but I think we may be in better shape than was previously thought.What does everyone else think?