Delawaredave5

Full time employment: Posting here.

- Joined

- Dec 22, 2004

- Messages

- 699

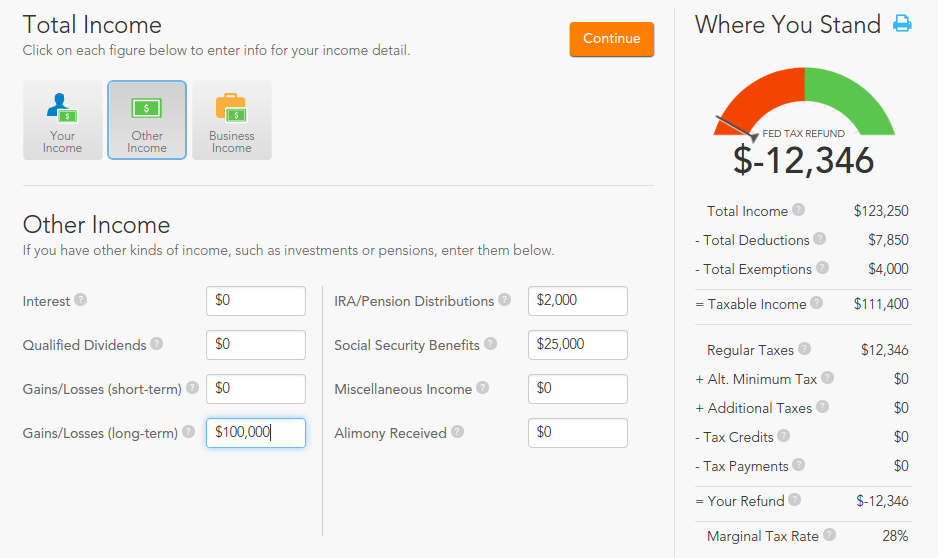

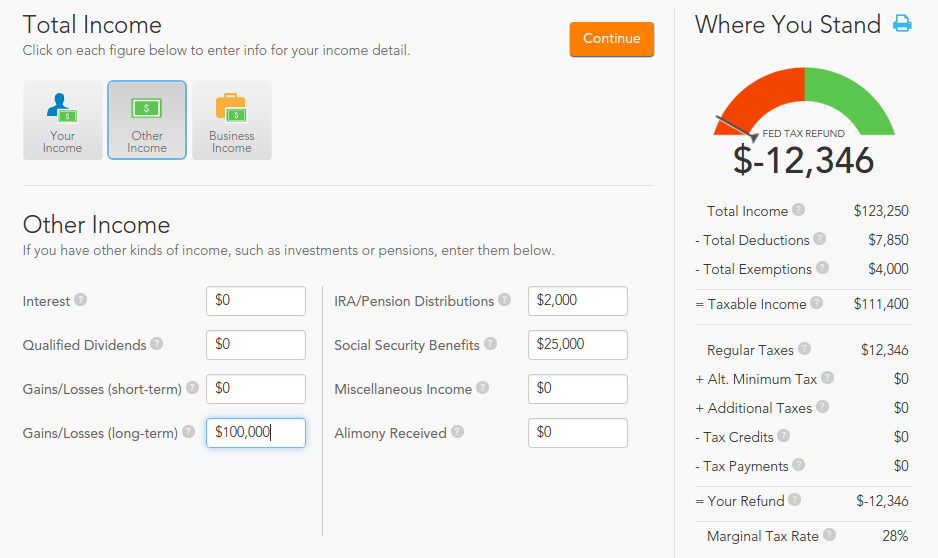

So if a senior only has about $25,000 in SS income and little/no dividends, then their long term capital gain rate is 0%, correct ?

Is there any limit on the amount of gains ? Doesn't seem like there is.

So if a person had $100,000+ in long term stock gains, and below $37,450 in ordinary income, then there'd be zero taxes due on the long term gain.

Thanks for any comments/confirmations.

Taxes on Income and Capital Gains for 2015

Is there any limit on the amount of gains ? Doesn't seem like there is.

So if a person had $100,000+ in long term stock gains, and below $37,450 in ordinary income, then there'd be zero taxes due on the long term gain.

Thanks for any comments/confirmations.

Taxes on Income and Capital Gains for 2015