BooBoo

Recycles dryer sheets

- Joined

- Oct 31, 2010

- Messages

- 91

Limited Time Offer

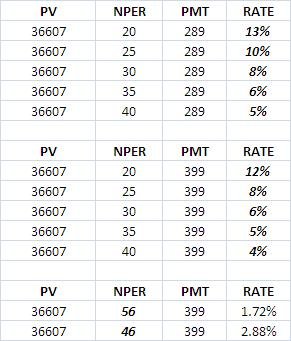

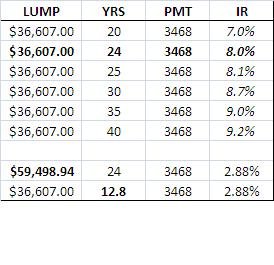

I just received a letter regarding a pension I am eligible to receive. A lump sum payout option is being offered. I must decide by the end of the month. The lump sum offer may or may not be offered again. The annuity options will still be offered. Here are the details.

Lump Sum: $36,607

Pension @ 65: $399 per month

Pension now @ 56: 289 per month

Immediate annuity says a lump sum of $36607 provides $165 to $173 per month depending on option selected. $63966 would be needed for $289 monthly payments.

Another site calculated the current monthly benefits to be worth $99787 as a lump sum.

I ran firecalc and looks like it was show a monthly payout of $113 per month with 99% chance of success. $93110 Starting portfolio value with 99% chance of success.

Based on my calculations, this is one of those limited time offers to be rejected. Am I missing something?

If I engaged a financial planner in this exercise, which I do not think is required. What would be a fair price or how much time would be required for this exercise?

Your input is appreciated.

I just received a letter regarding a pension I am eligible to receive. A lump sum payout option is being offered. I must decide by the end of the month. The lump sum offer may or may not be offered again. The annuity options will still be offered. Here are the details.

Lump Sum: $36,607

Pension @ 65: $399 per month

Pension now @ 56: 289 per month

Immediate annuity says a lump sum of $36607 provides $165 to $173 per month depending on option selected. $63966 would be needed for $289 monthly payments.

Another site calculated the current monthly benefits to be worth $99787 as a lump sum.

I ran firecalc and looks like it was show a monthly payout of $113 per month with 99% chance of success. $93110 Starting portfolio value with 99% chance of success.

Based on my calculations, this is one of those limited time offers to be rejected. Am I missing something?

If I engaged a financial planner in this exercise, which I do not think is required. What would be a fair price or how much time would be required for this exercise?

Your input is appreciated.