Real case scenario for living on SS.

Posted earlier in the thread, but thought to get down to the basics of what one can expect from SS, and the basic-basic income that would be available after the deductions for medicare A&B, and then the cost of Medicare D, and finally the cost of a basic healthcare supplement.

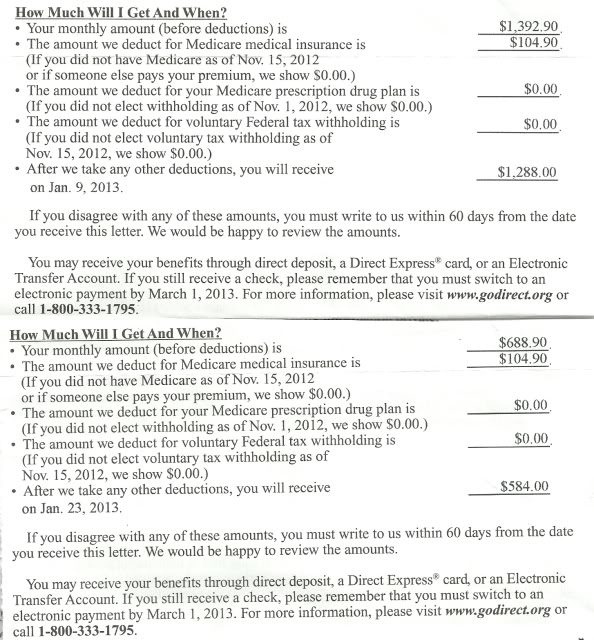

Here's what the SS notification looks like, for those who haven't started on SS Mine, and DW's, Which is one half of mine, since her SS quarters and income were less than half of mine... My SS was taken at age 62 (15 years ago) and is the current amount, which includes all adjustments, since 1999. The difference between taking at age 62 and full retirement is 30%.

The dollar amount reflected the

maximum input for the best quarters.

Thus, for one person one month basic health and SS net:

$1393 SS Gross

less:

$105 Medicare

$156 Medicare supplement

$ 41 Medicare D

$ 12 Medicare B deductible

Equals

$1078/month or $12936 per year for me.

That amount does not cover the co-pay for drugs or any optometry or dental costs.

I do this calculation because it represents what I consider to be the base cost on which to build an austerity budget. Since the average Social Security recipient in 2012 received $1230 gross SS, it would leave for all expenses...

$915/month out of which would have to come:

food

rent

uncovered medical costs... drugs, eye care, dental

utilities

transportation

and all other expenses

....................................................................

Beyond this, with no other source of income, a person would have to rely on government or private safety nets.