Need Roth conversion help, please.

After crunching my numbers thru 2018 Turbo Tax, I'm planning on doing a tIRA to Roth conversion today.

What are the mechanics?

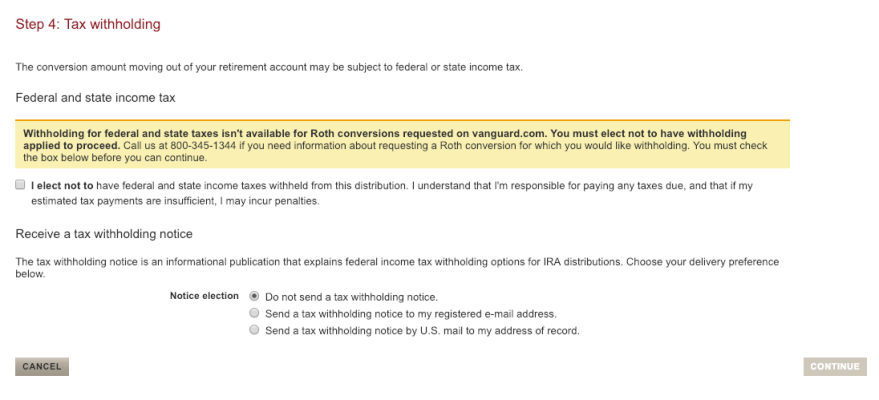

On Vanguard, it sounds like you simply find the order screen and convert?

On Fidelity, it sounds like it's easier if execute order during the 2-hour window after market close? Per swakybaby on a recent thread: If you place the conversion order after the market closes for the day but no later than 2 hours after the market closes, you will know the exact share price and it’s clearly indicated in your Fidelity order screen. If you divide the desired dollar amount by the share price, you get the exact number of shares to convert. There’s no guesswork required.

omni

After crunching my numbers thru 2018 Turbo Tax, I'm planning on doing a tIRA to Roth conversion today.

What are the mechanics?

On Vanguard, it sounds like you simply find the order screen and convert?

On Fidelity, it sounds like it's easier if execute order during the 2-hour window after market close? Per swakybaby on a recent thread: If you place the conversion order after the market closes for the day but no later than 2 hours after the market closes, you will know the exact share price and it’s clearly indicated in your Fidelity order screen. If you divide the desired dollar amount by the share price, you get the exact number of shares to convert. There’s no guesswork required.

omni