Greencheese

Recycles dryer sheets

- Joined

- Oct 6, 2013

- Messages

- 265

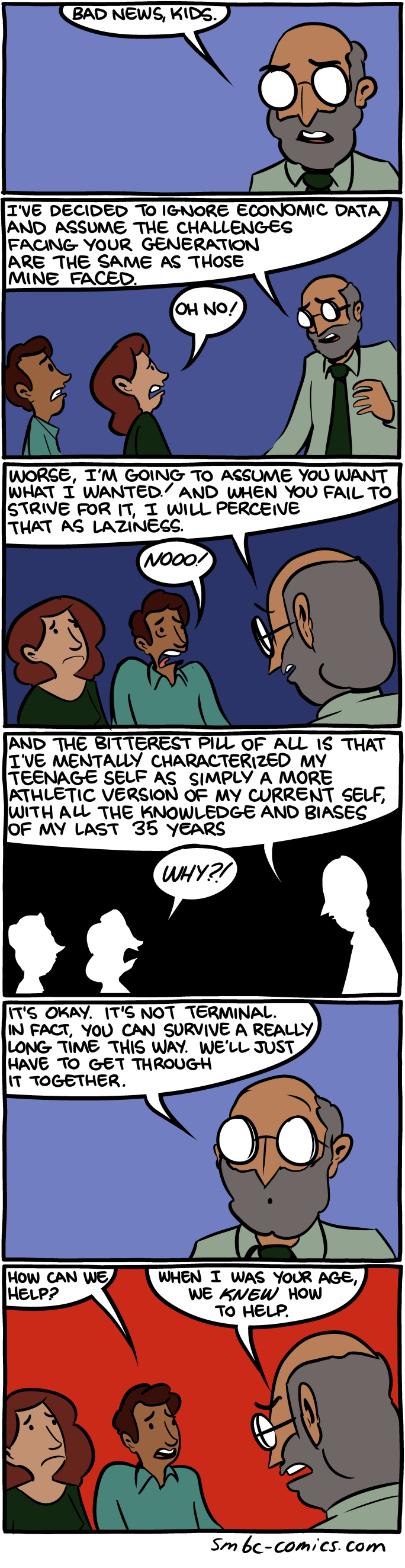

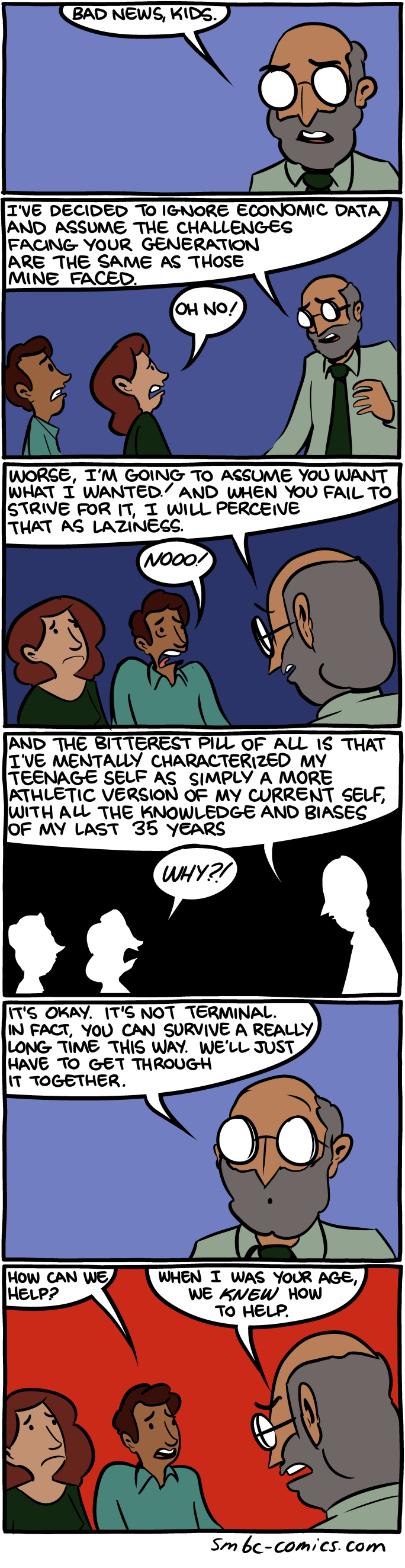

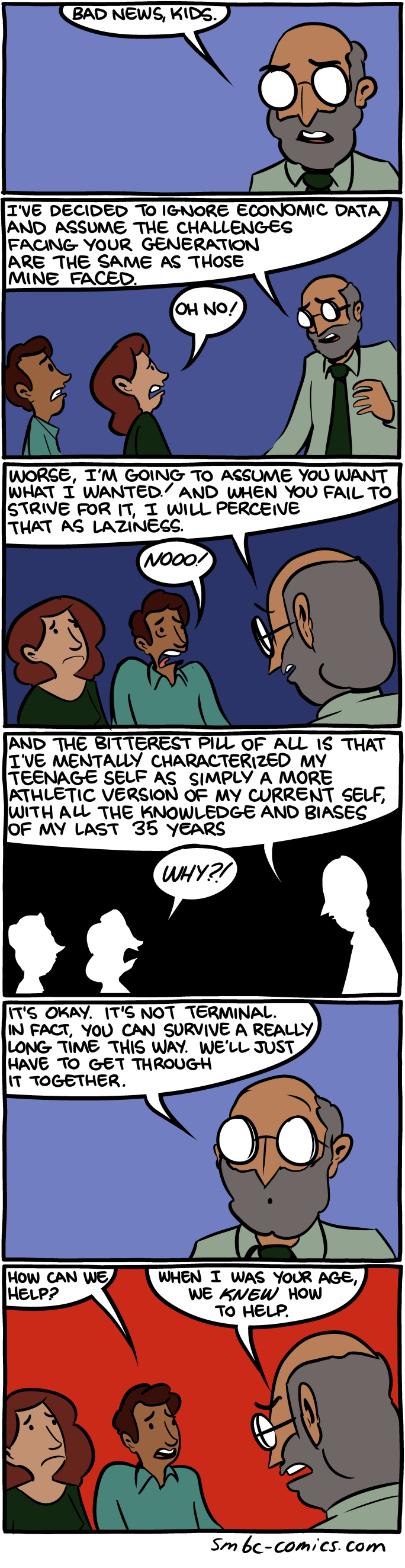

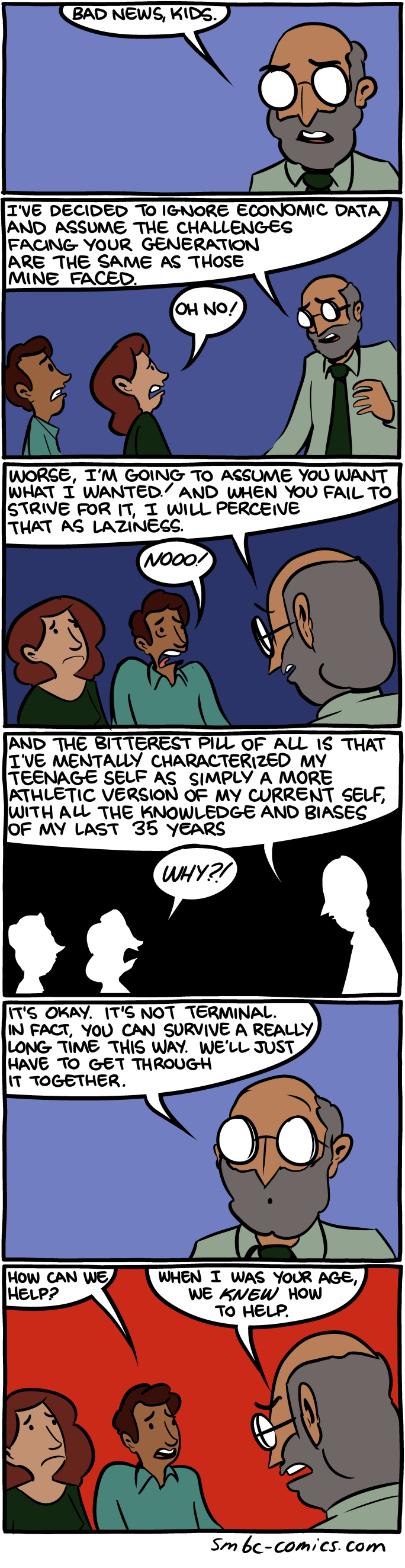

I found this comic to be rather humorous given this thread

We're following the advice above:

- Taking AP (and starting next year, IB) courses. This year he's in AP world history and AP computer science.

- Setting his expectations as to what we'll offer towards college (fixed amount per year, enough to graduate debt free from UC or CSU.)

- Told him there's no shame in Community College first.... and might be a better path if he wants to go to a UC school (path to transfer that guarantees acceptance if you follow it carefuly.)

- Told him we have veto power over the major. He knows our criteria is based on a job at the end.

I know we're "hell bent" in this country to achieve the dream of college education, but what's wrong with learning a trade? Mike Rowe has a foundation that helps our young people attain such experience. About the Foundation « Profoundly Disconnected

I found this comic to be rather humorous given this thread

I suppose I'm just upset that my assets were fully exposed, and I have to pay full boat where as many earning the same or more then I will get close to free rides, through "institutional" grants and other easy financing options.

I read somewhere: "Life isn't fair. Your job is to figure out where it's not fair in your favor and go there"

I know we're "hell bent" in this country to achieve the dream of college education, but what's wrong with learning a trade? Mike Rowe has a foundation that helps our young people attain such experience. About the Foundation « Profoundly Disconnected

Some of the wealthiest people in our section of the county, were plumbers or construction people who started their own businesses.

Sounds like normal people. Hmm...you could almost call them the millionaire next door.

College debt is not necessarily something people shed in middle age. According to the U.S. Consumer Financial Protection Bureau, the number of those 60 or older with student loan debt grew from about 700,000 to 2.8 million from 2005 to 2015. Their total bill is $66.7 billion.

Interesting overview of the staying power of education debt:

Quote:

College debt is not necessarily something people shed in middle age. According to the U.S. Consumer Financial Protection Bureau, the number of those 60 or older with student loan debt grew from about 700,000 to 2.8 million from 2005 to 2015. Their total bill is $66.7 billion.

I've been going through this with my son - he's a senior in high school and wants to be an engineer. He applied to a couple on in-state schools (tuition, room, board ~$23K/yr) but also wanted to apply to one out-of-state school (tuition, room, board ~$48K/yr). We let him apply, but he understood that absent some sort of out-of-state tuition waiver, there was no way we were paying an additional $100K for him to go out of state.

In our case, we can argue whether or not the in-state options (UT Austin, Texas A&M) are as "elite" as the out-of-state school (Georgia Tech), but there's no way I'd ever encourage him to take on $100K in debt to go to Ga Tech.

If your kid does well in high school, there are some schools that offer some pretty nice packages. For example, if your child gets at least a 32 on the ACT and has a 3.5 GPA, they'll get their tuition paid for at the University of Alabama (worth $27K/yr for 4 years). With a 30 on the ACT, the school will cover 2/3 of the tuition ($18K/yr). Now, no one is going to confuse Alabama for Stanford or MIT, but we then get back to the question of whether or not an "elite" school is required for success (it's not).

Another thing to look at is the cost of books. I know that it pales in comparison to tuition, room and board, but there are options to save money. I have a daughter who is a junior in mechanical engineering. In her 3 years of college, we've spent about $750 on books. We'll rent the required textbook, and if she wants/needs a copy for future reference, I'll buy the same book but an edition or two older. This semester, her fluid mechanics book is $240 new from Amazon (or the bookstore). I can rent it for $39 from Amazon and purchase the same book but two editions older for $4.99 (including shipping). And the basics of fluid mechanics hasn't changed in a long, long time, so it's not like the older book is out of date. So, I'm out $44 instead of $240. Multiply this for 4-5 classes each semester and it adds up.

Scholars receive annual awards that range from $5,400 to $72,000

(four-year awards total an average of $20,000-288,000) with

additional funds for enrichment activities such as study abroad,

academic conferences, and leadership training. the stamps foundation

and partner schools evenly share the costs of the awards.

Interesting overview of the staying power of education debt:

I agree that colleges are getting out of control expensive. I think over the next decade that trend will stop or they will be priced out.

This is one of the reasons I pursued duel citizenship for my sons (Italy).... If they choose to go to school in the schengen region they won't have visa issues. Only downside I can see is the 529 funds don't work for many European universities. Not the end of the world....Another way around: get your degree in Germany (or a few other European places). Germany is (quasi) free I think, Belgium is close with about 1.000 USD per year for tuition. Just as an example.

Bonuses: you'll learn another language, get some good social skills, a broader perspective etc ..

This is one of the reasons I pursued duel citizenship for my sons (Italy)...

Loro combattono molto.Because they fight a lot, right?