Independent

Thinks s/he gets paid by the post

- Joined

- Oct 28, 2006

- Messages

- 4,629

May I ask how many of those who retired here in 2002 are drawing 20k more out of their portfolio than they started drawing in 2002If you are, you better plan on going back to work soon given the last 10 years return. How many of you who retired in 1990 are drawing fully 2x the amount you did in 1990?? I really do understand inflation could be a big problem for a fixed income investor like me but....are we overstating the real effects here? I am not trolling here. Just trying to decide if I want this approach or a total return 4% inflation adjusted withdrawal approach. Something about consuming principle scares me...can't really help it.

Yes, inflation is real. I've only been retired for 6 years, but we started keeping track of expenses when we were married in 1970. I dug out some old ledgers.

This is our monthly "food" spending for 71, 72, 73, and 74: $70.58 $68.33 $74.91 $89.33

For comparison, we averaged about $550 per month on the same items over the last 4 years.

(That includes everything we buy at the supermarket including detergent, TP, toothpaste, etc.)

Auto went from under $40 per month to over $250 (both exclude purchases).

Sure, that's 40 years ago. But you're planning on a 40 year retirement.

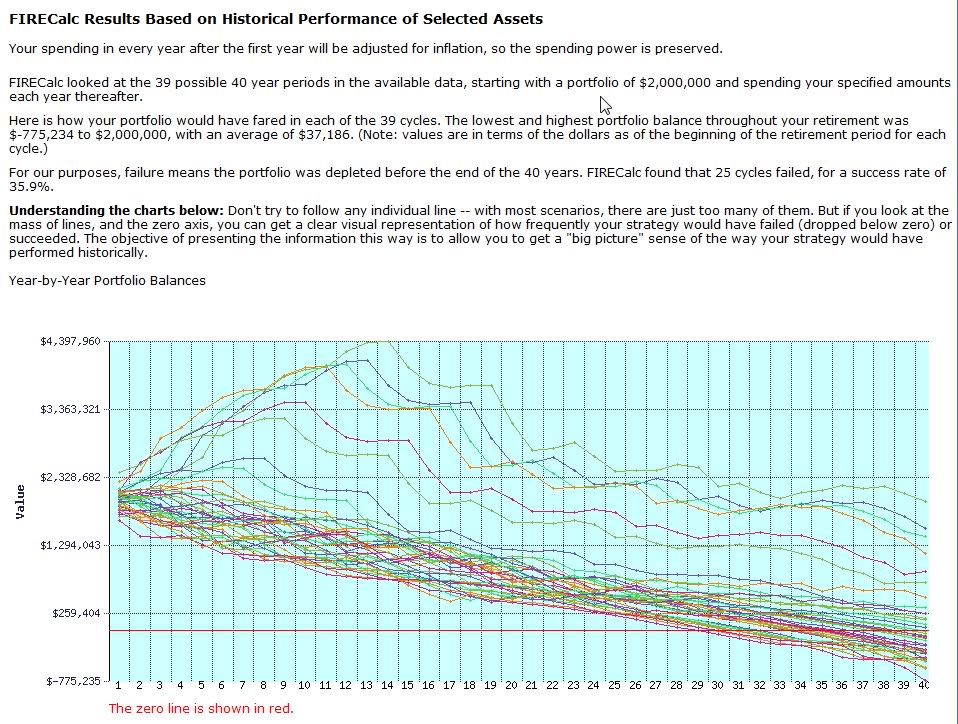

I think the important thing for you is the other sources of income that you've already listed. I expect that if you put them all into FireCalc (or a spreadsheet you create) your survival rate will go up dramatically. SS is COLA'd, and that can be a big deal.

Many people think that the US is bound to go through another period of high inflation sometime in the next 40 years. You may think you can keep your personal inflation rate at 2% when the CPI says 3%, but what will you do if the CPI is 10%?

Or, you may be thinking that retired people have a natural tendency to decrease consumption over time. You should model that explicitly, how much less do you see yourself consuming at 63, 73, 83, etc?

Last edited: