JPatrick

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2005

- Messages

- 2,610

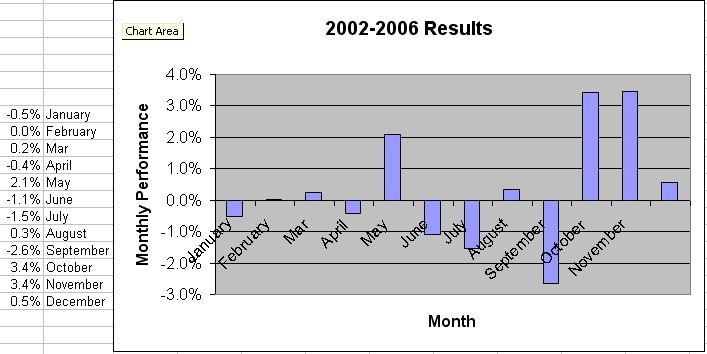

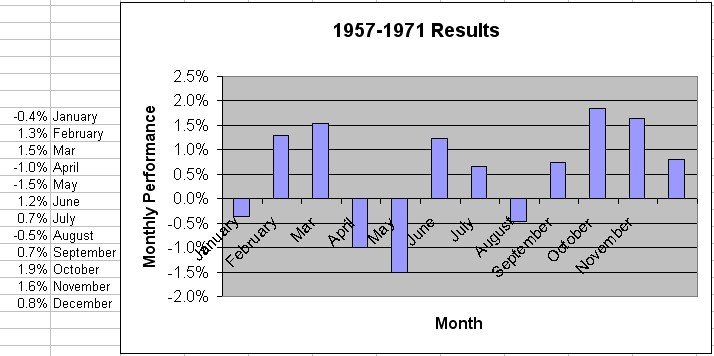

As we approach the end of each month I drag out old reliable for inspiration. The numbers are not really important - it's the trend. Almost any series of years you crunch (at least 15 years provides the same trend).

It is effective in at least two ways.

1. If the trailing 3 to 6 months are in line with the chart, the possibility is strong that the next month will follow suit. If the numbers are off, all bets are off for the short term.

2. For those struggling with the age old question=Lump sum or a little now, a little later, this is a decent macro timing tool.

Anyway, based on this chart and the past few months, I'd bet on a weaker March. A gain would be nice, but a break even may end up being a gift.

It is effective in at least two ways.

1. If the trailing 3 to 6 months are in line with the chart, the possibility is strong that the next month will follow suit. If the numbers are off, all bets are off for the short term.

2. For those struggling with the age old question=Lump sum or a little now, a little later, this is a decent macro timing tool.

Anyway, based on this chart and the past few months, I'd bet on a weaker March. A gain would be nice, but a break even may end up being a gift.