Ian S

Thinks s/he gets paid by the post

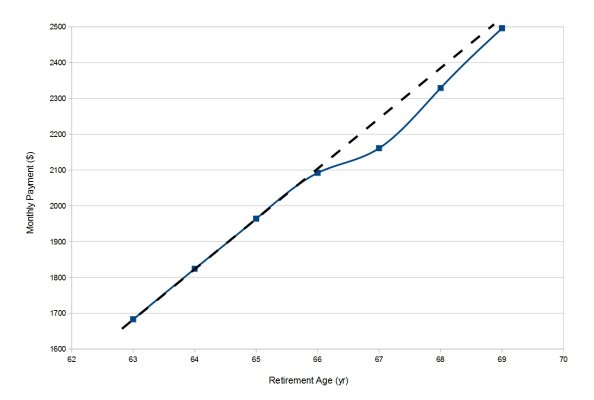

Like many, I'm looking into when to start taking Social Security and have used the downloaded ANY PIA calculator to look at various scenarios. Since I have already stopped working, I have only input that actual income amounts from my past working years up to 2014 (age 63) and nothing beyond. When I calculate monthly payments as a function of age when payments start, I get the odd behavior shown in the attached graph. There's a fairly linear increase to age 66 (dashed line) but then an abrupt curve shift to the right which means the increase in payment going from 66 to 67 is considerably less than in prior years. Has anyone else seen this behavior? Is it a quirk of the software or is there something else I'm missing e.g. improper input or setting? Thanks for any help.