cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

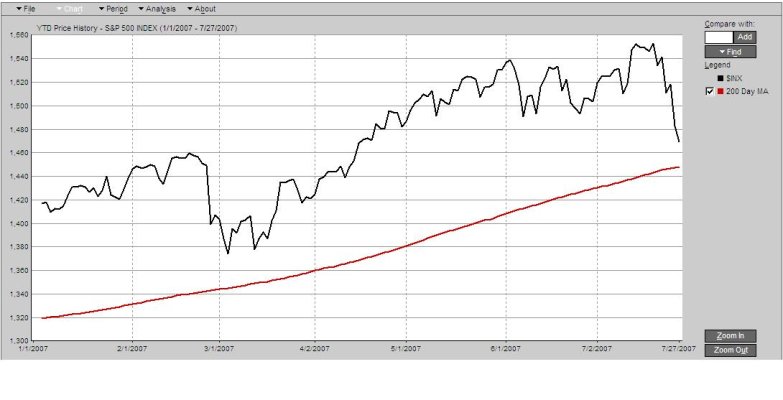

For those of you with strong, red market timing blood in your veins, with its losses today so far, the s&p500 seems headed for a collision with its 200 day moving average line.

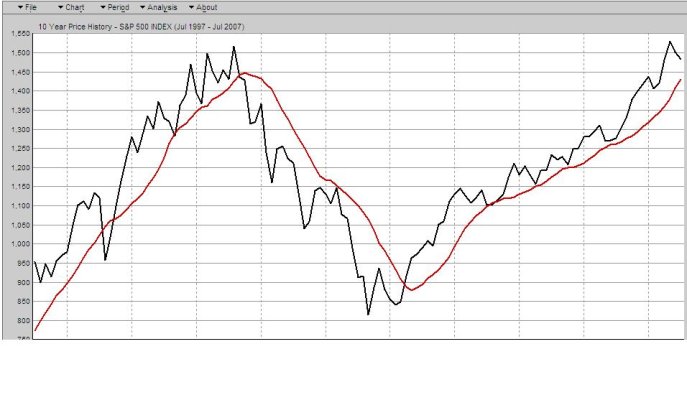

Breaking the 200 day MA to the downside has been a pretty good predictor of when to get out (if you havent already). Breaking to the upside has been a pretty good predictor of when to get in...

But the practice DOES have its detractors...

Breaking the 200 day MA to the downside has been a pretty good predictor of when to get out (if you havent already). Breaking to the upside has been a pretty good predictor of when to get in...

But the practice DOES have its detractors...

. All this looks really appealing until you get whipsawed or miss a market turn.

. All this looks really appealing until you get whipsawed or miss a market turn.