FireBug

Recycles dryer sheets

Hi… I’m wondering if some of you folks could comment with your personal thoughts regarding my pension options. I’m 60 and left the work force 5 months ago. I don’t consider myself retired as I am currently a ‘kept man’. DW is just turning 58 and plans on retiring in about 3 years. At that time, I (we) will be considered retired.

· What’s mine is hers, and what’s hers is mine

· Both professionals with the same earnings records

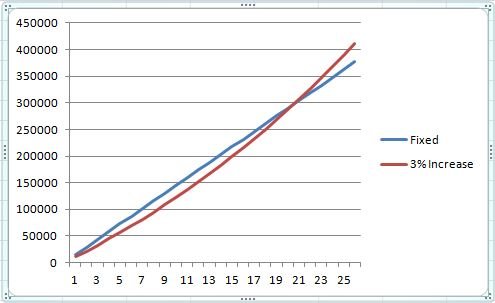

I’m thinking I want to ensure a steady, inflation protected income stream to cover our budgetary items. This would be done with SS (hers and mine) and taking our pensions. The rest will come from our 401k’s, investments, and some ROTH stuff. DW has a pension and I’m just now starting to learn the details of it (difficult getting specifics from her employer). My projection is that her pension (in three years’ time), will be about the same as what mine is currently...same, same. Attached is a shot of my pension options if I start taking it now. I’m thinking on doing the 3% cola with a five year certainty. I can bank my payments for the next three years to use in the early stages of retirement. My sister tells me the 3% yearly increase looks very good. But here is the wuss in me. With effectively no survivor benefits, if I die sooner than later, nothing goes to my wife or heirs….and I can’t stand the idea of my money going to the Mega Corp. DW would also take an option such as mine with her pension, so with SS1, SS2, pension1, and Pension2 we could (as a couple) have a protected income stream to cover our recurring costs. Health? Well, I always thought I was in decent shape, but I need to lose some lbs. I look at the obits and it seems everyone is doing a Jimmy Durante “Kicking the bucket” in their mid 70’s or earlier (I know…. quit looking at the obits). Wife is in great shape but is a Type 1 diabetic. Another option is to lump sum it and manage it ourselves. There is so much discussion about pensions and annuities on this board that the only thing I can distill from it all is that it's imperative that you know when you will die and if you are talking about a pension with COLA….grab it. So someone tell me, forget death, taxes, and inheritance issues and take the guaranteed $.

Projecting out, in three years’ time, DW’s pension along with mine should represent about 20% of our total portfolio. And thanks.

NOTE: edited to agree COLA was used inappropriately here. My pension would simply increase each year by 3%.

· What’s mine is hers, and what’s hers is mine

· Both professionals with the same earnings records

I’m thinking I want to ensure a steady, inflation protected income stream to cover our budgetary items. This would be done with SS (hers and mine) and taking our pensions. The rest will come from our 401k’s, investments, and some ROTH stuff. DW has a pension and I’m just now starting to learn the details of it (difficult getting specifics from her employer). My projection is that her pension (in three years’ time), will be about the same as what mine is currently...same, same. Attached is a shot of my pension options if I start taking it now. I’m thinking on doing the 3% cola with a five year certainty. I can bank my payments for the next three years to use in the early stages of retirement. My sister tells me the 3% yearly increase looks very good. But here is the wuss in me. With effectively no survivor benefits, if I die sooner than later, nothing goes to my wife or heirs….and I can’t stand the idea of my money going to the Mega Corp. DW would also take an option such as mine with her pension, so with SS1, SS2, pension1, and Pension2 we could (as a couple) have a protected income stream to cover our recurring costs. Health? Well, I always thought I was in decent shape, but I need to lose some lbs. I look at the obits and it seems everyone is doing a Jimmy Durante “Kicking the bucket” in their mid 70’s or earlier (I know…. quit looking at the obits). Wife is in great shape but is a Type 1 diabetic. Another option is to lump sum it and manage it ourselves. There is so much discussion about pensions and annuities on this board that the only thing I can distill from it all is that it's imperative that you know when you will die and if you are talking about a pension with COLA….grab it. So someone tell me, forget death, taxes, and inheritance issues and take the guaranteed $.

Projecting out, in three years’ time, DW’s pension along with mine should represent about 20% of our total portfolio. And thanks.

NOTE: edited to agree COLA was used inappropriately here. My pension would simply increase each year by 3%.

Attachments

Last edited: