calmloki

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

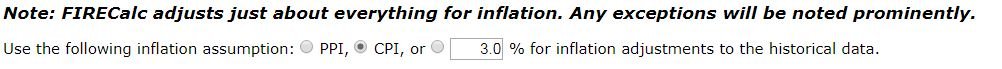

real simple - when you fill out retirement planners like Firecalc what do you use as an inflation rate? For extra internet credit (and not part of the survey) what do you use as a rate of return?

I use 3 or 3.5% for inflation and 3% for return because my name is Eeyore.

1. 2% inflation,

2. 3% inflation,

3. 4% inflation,

4. 5% inflation,

5. 6% inflation,

6. 7% inflation,

7. 8% inflation,

8. it's the end of the world as we know it 1980

Historical Inflation Rates: 1914-2017 | US Inflation Calculator

I use 3 or 3.5% for inflation and 3% for return because my name is Eeyore.

1. 2% inflation,

2. 3% inflation,

3. 4% inflation,

4. 5% inflation,

5. 6% inflation,

6. 7% inflation,

7. 8% inflation,

8. it's the end of the world as we know it 1980

Historical Inflation Rates: 1914-2017 | US Inflation Calculator