You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Puerto Rico and Act 22

- Thread starter Jmo1969

- Start date

Puerto Rico - Income tax exemption granted to non-residents who establish domicile within a specified timeframe

Download

Global Watch (Dec 2012)

During 2012, Acts 22-2012 and 138-2012 were approved by the Legislative Assembly of Puerto Rico. The purpose of these measures is to provide incentives to individuals who have NOT been residents of Puerto Rico during the past 15 years, to become residents of Puerto Rico. In order to encourage the transfer of such individuals to Puerto Rico, the Acts completely exempt from Puerto Rico income tax their passive income, which may consist of interest, dividends, and capital gains.

Download

Global Watch (Dec 2012)

During 2012, Acts 22-2012 and 138-2012 were approved by the Legislative Assembly of Puerto Rico. The purpose of these measures is to provide incentives to individuals who have NOT been residents of Puerto Rico during the past 15 years, to become residents of Puerto Rico. In order to encourage the transfer of such individuals to Puerto Rico, the Acts completely exempt from Puerto Rico income tax their passive income, which may consist of interest, dividends, and capital gains.

Puerto Rico has other issues and other taxes besides their territorial income tax. If avoiding these taxes is your goal, why not Florida, Texas, Washington, and other no income tax states. Moving to Puerto Rico doesn't exempt you from US income taxes. You appear to already be living in a no-income tax state. Why are you interested in PR?

There have been numerous threads concerning retirees establishing residency in a non-income tax state. This is very easy and allows one to travel widely without worring about state taxes. Of course, trying to keep a home in California, Illinois or another high tax state may raise issues with them attempting to disallow your change in residency.

There have been numerous threads concerning retirees establishing residency in a non-income tax state. This is very easy and allows one to travel widely without worring about state taxes. Of course, trying to keep a home in California, Illinois or another high tax state may raise issues with them attempting to disallow your change in residency.

Why are you interested in PR?

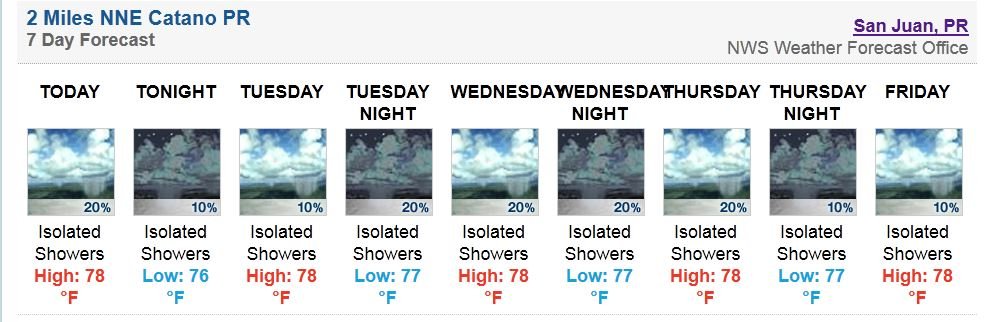

Here's one good reason:

Attachments

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Moving to Puerto Rico doesn't exempt you from US income taxes.

Actually, I believe it does which is why it was so controversial when PR put this law in place.

The terms of the deal basically say that you would have to spend half the year or more in PR. You would also probably be inviting heavy IRS scrutiny. Better be a fluent Spanish speaker as well.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

Actually, I believe it does which is why it was so controversial when PR put this law in place. The terms of the deal basically say that you would have to spend half the year or more in PR. You would also probably be inviting heavy IRS scrutiny. Better be a fluent Spanish speaker as well.

The way I read it, it exempts you only from capital gains, not income. Sounds like some mega rich could benefit, but no benefit for a US pensioner like me. Well the upside is I don't have to learn Spanish!

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

There is zero federal income taxes in PR. So you will pay zero taxes on any PASSIVE income you earn. That's interest and dividends.

I am no expert, and I am only seeing it through my situation, but if I moved there my pension income would be taxed fully from US government and I could not escape any taxation from it. I would see a slight reduction based on my small annual capital gains, but that could be accomplished by moving to a specific state or even the USVI.

I was in PR for a couple of weeks while in the Navy a few years back. Didn't feel the love of us gringo's there much. In fact some were fairly hostile.

Professional neighbor of mine w#rked there on assignment recently & felt the same way. He loved the climate, but almost feared for his safety. He jumped at the next available assignment to get out.

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Professional neighbor of mine w#rked there on assignment recently & felt the same way. He loved the climate, but almost feared for his safety. He jumped at the next available assignment to get out.

I never felt any of that. Perhaps it was because I grew up in Queens and it was fairly obvious. PR is the 6th borough of NYC, so much so that the New York Fed regulates Puerto Rican bank holding companies.

Gearhead Jim

Full time employment: Posting here.

Puerto Rico has other issues and other taxes besides their territorial income tax. If avoiding these taxes is your goal, why not Florida, Texas, Washington, and other no income tax states. Moving to Puerto Rico doesn't exempt you from US income taxes. You appear to already be living in a no-income tax state. Why are you interested in PR?

There have been numerous threads concerning retirees establishing residency in a non-income tax state. This is very easy and allows one to travel widely without worring about state taxes. Of course, trying to keep a home in California, Illinois or another high tax state may raise issues with them attempting to disallow your change in residency.

Illinois does not tax qualified pensions including IRA's or social security.

My pension, my IRAs, my social security, my wife's IRAs, and her social security; are all untaxed by Illinois.

Certainly that may not last forever, but I've been retired for 8 years with a very comfortable income, and have paid no Illinois income tax.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

A couple years ago when I retired to draw a pension, it entered my mind to move across the river into Illinois to save $3k a year in income taxes. But I would have to live on a city park bench to come out ahead as the property taxes would have swallowed up the savings for me.Illinois does not tax qualified pensions including IRA's or social security. My pension, my IRAs, my social security, my wife's IRAs, and her social security; are all untaxed by Illinois. Certainly that may not last forever, but I've been retired for 8 years with a very comfortable income, and have paid no Illinois income tax.

aja8888

Moderator Emeritus

My business trips to PR indicated that unless you are in San Juan, the rest of the island is pretty much a step into poverty and high unemployment (~30%). Much of industry is leaving or has left (refining, drug manufacture (legal), tuna canning, etc. I had my AMEX card hacked there for $18K overnight.

Plus, while the winter weather is nice, the summers are brutal. Everything turns to rust in a matter of a few years, too. Just not a fun place for retiring.

Plus, while the winter weather is nice, the summers are brutal. Everything turns to rust in a matter of a few years, too. Just not a fun place for retiring.

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

My business trips to PR indicated that unless you are in San Juan, the rest of the island is pretty much a step into poverty and high unemployment (~30%). Much of industry is leaving or has left (refining, drug manufacture (legal), tuna canning, etc. I had my AMEX card hacked there for $18K overnight.

Plus, while the winter weather is nice, the summers are brutal. Everything turns to rust in a matter of a few years, too. Just not a fun place for retiring.

Different strokes. If my life ever went pear-shaped in a major way, I always figured I would start over in PR, preferably Vieques or Culebra.

aja8888

Moderator Emeritus

Different strokes. If my life ever went pear-shaped in a major way, I always figured I would start over in PR, preferably Vieques or Culebra.

I have not thought of what I would do if the air was suddenly let out of my balloon, but maybe I should give it some thought too!

My trips to the island have taken me to dying plants like the Bumble Bee tuna canning one in Mayaguez and the Conoco Phillips petrochemical facility in Guayama. I have also been to other chemical facilities in the territory over the last 15 years. All of this crumbling of industry has left the place in dire straits for wage growth or stability. It's a shame as it is quite a beautiful and scenic place.

Throw in lots of work in Trinidad too! (actually natural gas finds in recent years have saved T&T). Still, most of the population lives in poverty.

Gearhead Jim

Full time employment: Posting here.

My business trips to PR indicated that unless you are in San Juan, the rest of the island is pretty much a step into poverty and high unemployment (~30%). Much of industry is leaving or has left (refining, drug manufacture (legal), tuna canning, etc. I had my AMEX card hacked there for $18K overnight.

Plus, while the winter weather is nice, the summers are brutal. Everything turns to rust in a matter of a few years, too. Just not a fun place for retiring.

+1

A few years ago, we went there in January and rented a car for two weeks. Did a leisurely beach bum drive around the island. It was just fine for that, and we might repeat the trip some day. But I too would never consider retiring there full time, or trying to earn a living there.

IIRC, even the poor houses have burglar bars on all the windows. Those are expensive, and not just for decoration.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My business trips to PR indicated that unless you are in San Juan, the rest of the island is pretty much a step into poverty and high unemployment (~30%). Much of industry is leaving or has left (refining, drug manufacture (legal), tuna canning, etc. I had my AMEX card hacked there for $18K overnight.

Plus, while the winter weather is nice, the summers are brutal. Everything turns to rust in a matter of a few years, too. Just not a fun place for retiring.

So have a lot of businesses moved out in the past few decades?

I was there on business in 1982, and the poor sections that I saw didn't strike me as dangerous or poverty stricken, just poor. I didn't encounter any beggars or scammers - it seemed way different from Jamaica (in the same time period) in that regard.

But back them, there was a fair amount of industry in PR, the big electronics companies and pharmaceuticals seemed to all have some presence. I was told there were tax advantages for businesses to locate there, but never heard the details.

-ERD50

aja8888

Moderator Emeritus

So have a lot of businesses moved out in the past few decades?

I was there on business in 1982, and the poor sections that I saw didn't strike me as dangerous or poverty stricken, just poor. I didn't encounter any beggars or scammers - it seemed way different from Jamaica (in the same time period) in that regard.

But back them, there was a fair amount of industry in PR, the big electronics companies and pharmaceuticals seemed to all have some presence. I was told there were tax advantages for businesses to locate there, but never heard the details.

-ERD50

I made several trips there between 1995 and 2009 on various projects, mostly associated with attempting to bring industrail facilities back to life or sell to a new operator.

The oil/chemicals business is just about gone. The Conoco Phillips plant I was at to help with its potential sale, was rusting into the ground and had to be updated ($$$$) to meet EPA Region 2 air emissions standards (which was not cost effective). I'm not sure if the plant is sold (it made gasoline and some derivitve chemicals when operating) as the buyers usually walk away after their engineers have a close look at it. At the time, CP had about 175 people working at the plant and it was not running.

Other plants I have been to are having a problem dealing with corrosion and faced very costly storage tank replacements and unit rebuilds. These plants were shut down after I left. I was working for a potential lender who was considering a large funding to the operators (fell through).

One thing killing the refining business there is the crude feedstock has to be imported and that is costly. Plus, the refined product makes sense to be sold locally. The Conoco refinery was using a naphthalene feedstock from what I remember, and not crude.

The tuna canning industry is about 1//5 of capacity as we were at the area of the island where Bumble Bee was trying to keep their old plant in operation. I'm sure it's either been shut down and production moved elsewhere or just barely operating.

Last time I was there, a drug producer was shutting down its plant (Teva?).

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

+1 A few years ago, we went there in January and rented a car for two weeks. Did a leisurely beach bum drive around the island. It was just fine for that, and we might repeat the trip some day. But I too would never consider retiring there full time, or trying to earn a living there. IIRC, even the poor houses have burglar bars on all the windows. Those are expensive, and not just for decoration.

Several years ago, when wanting to vacation in the Caribbean, I did a lot of reading online about places to go. And like St. Thomas (they have burglar bars aplenty also) there are places to go and not to go after dark. I don't have time for any of that. That is why I just use San Juan as an air connection to get me to St. John every year. No crime worries there.

Similar threads

- Replies

- 15

- Views

- 597

- Replies

- 14

- Views

- 850

- Replies

- 8

- Views

- 584