Badger

Thinks s/he gets paid by the post

- Joined

- Nov 2, 2008

- Messages

- 3,411

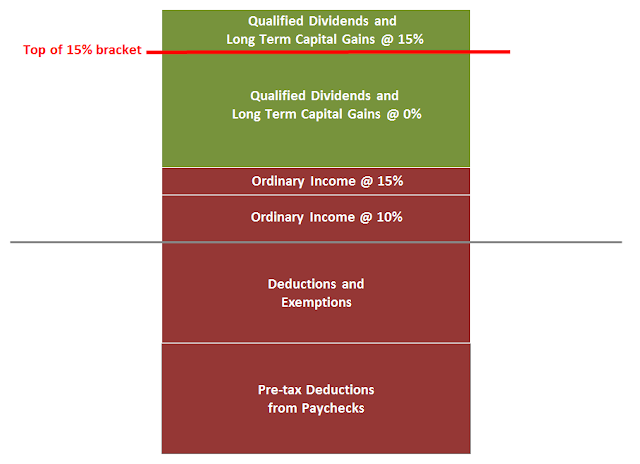

I am planning to convert some tIRA funds to rIRA funds before the end of the year while I am in the 15% bracket. I just need to check what happens if I go over maximum allowed amount.

I have not run any "what ifs" with tax software but if I understand correctly I will be taxed 15% up to the maximum allowed then any additional money over that would be taxed at the next higher rate (25%). Is this correct?

I was thinking to take advantage of the lower taxes now since in a few years I will be in the 25% bracket due to manditory tIRA withdrawl at 70.5 yrs. If I do exceed the 15% limit now then the additional converted money that is taxed at 25% would really break even for my future taxes.

Does this sound right?

Cheers!

I have not run any "what ifs" with tax software but if I understand correctly I will be taxed 15% up to the maximum allowed then any additional money over that would be taxed at the next higher rate (25%). Is this correct?

I was thinking to take advantage of the lower taxes now since in a few years I will be in the 25% bracket due to manditory tIRA withdrawl at 70.5 yrs. If I do exceed the 15% limit now then the additional converted money that is taxed at 25% would really break even for my future taxes.

Does this sound right?

Cheers!