As if we don't have enough threads (however I don't want to hijack any, either).

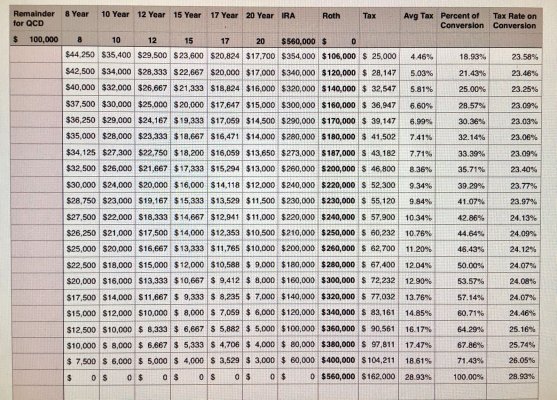

Assumptions for my chart: 54 and 52 years old

-I've run taxes due for me, MFJ (+one dep.), and forfeiting 7 months of ACA subsidy for this, our first year of FIRE.

-After this one year of conversion, no future taxes will be due if the future annual conversions are low enough to keep us qualified for the ACA subsidy (ballpark $84k including current investment income). Approx. $20-25k/year.

-Plan to leave $100k in the traditional IRA (after years of conversions) so it will fund future QCDs = the RMD

-The IRA column subtracts that $100k from the remaining balance and divides the balance by the years of future conversions

-Avg. tax rate=only the taxes due on this year's conversions as the balance is targeted as zero as well as leaving money for the QCD

-Guessing both of us will be OK but a cancer diagnosis raises the possibility that only one will be here (as a HoH) which wasn't planned for initially. This is one reason I have shorter years listed due to a possible change from MFJ to HoH if needed.

My questions are: are you seeing any glaring problems AND knowing the average TR on the conversion changes by about 1% for every $20,000, how much would you convert this year knowing it will then be growing in the Roth bucket henceforth? Being conservative, this Roth will hold more bonds than anything else so not likely to grow a lot but will be the ballast of the portfolio.

Assumptions for my chart: 54 and 52 years old

-I've run taxes due for me, MFJ (+one dep.), and forfeiting 7 months of ACA subsidy for this, our first year of FIRE.

-After this one year of conversion, no future taxes will be due if the future annual conversions are low enough to keep us qualified for the ACA subsidy (ballpark $84k including current investment income). Approx. $20-25k/year.

-Plan to leave $100k in the traditional IRA (after years of conversions) so it will fund future QCDs = the RMD

-The IRA column subtracts that $100k from the remaining balance and divides the balance by the years of future conversions

-Avg. tax rate=only the taxes due on this year's conversions as the balance is targeted as zero as well as leaving money for the QCD

-Guessing both of us will be OK but a cancer diagnosis raises the possibility that only one will be here (as a HoH) which wasn't planned for initially. This is one reason I have shorter years listed due to a possible change from MFJ to HoH if needed.

My questions are: are you seeing any glaring problems AND knowing the average TR on the conversion changes by about 1% for every $20,000, how much would you convert this year knowing it will then be growing in the Roth bucket henceforth? Being conservative, this Roth will hold more bonds than anything else so not likely to grow a lot but will be the ballast of the portfolio.

Attachments

Last edited: