almost_there

Dryer sheet aficionado

- Joined

- Sep 11, 2007

- Messages

- 41

I have been following the "Roth Conversions make sense?" thread with some interest. It has me asking some questions but I don't want to hijack that thread so I thought I would ask the questions in a new thread. Note I am > 59.5 and will be retiring the end of this year. Most of my assets are in a traditional IRA and a 401k. I do have a small ROTH IRA already. I have never done anything with these accounts except put money in. I realize that I am somewhat clueless about what happens when you take the money out prior to the RMDs starting.

Here goes:

1. A ROTH conversion seems to be when you take money out of the tIRA/401k and pay the taxes on it with already taxed money from some other source. If you pay the taxes via withholding from the tIRA/401k distribution can you still not put some or all of the proceeds into a ROTH IRA? Is the payment of the taxes from "after tax" money what makes it a conversion?

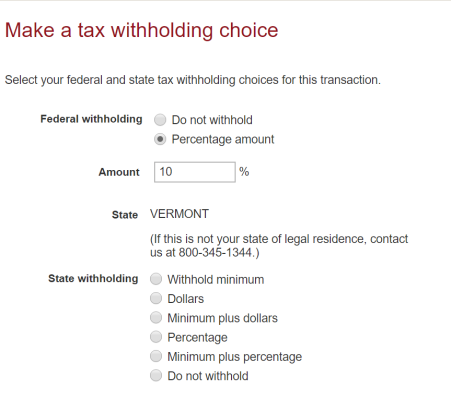

2. I always assumed that when I start withdrawing from my Vanguard tIRA of Fidelity 401k they will withhold for taxes. Is that the case? Can I ask them to not withhold? It would see that would be a requirement if you are going to pay the taxes from a different source. If they have to withhold how do they figure out the amount? Can I tell them or do they use some tax rules?

Thank You

Here goes:

1. A ROTH conversion seems to be when you take money out of the tIRA/401k and pay the taxes on it with already taxed money from some other source. If you pay the taxes via withholding from the tIRA/401k distribution can you still not put some or all of the proceeds into a ROTH IRA? Is the payment of the taxes from "after tax" money what makes it a conversion?

2. I always assumed that when I start withdrawing from my Vanguard tIRA of Fidelity 401k they will withhold for taxes. Is that the case? Can I ask them to not withhold? It would see that would be a requirement if you are going to pay the taxes from a different source. If they have to withhold how do they figure out the amount? Can I tell them or do they use some tax rules?

Thank You