Fast forward 8years and now these days how do you feel about the WR?

Funny you should ask right now. In the last 8 years, I’ve been working less and less instead of outright retiring. Loving it by the way! But, I’ve still covered all of my expenses with my work income. So, I’m not in the decumulation phase just yet.

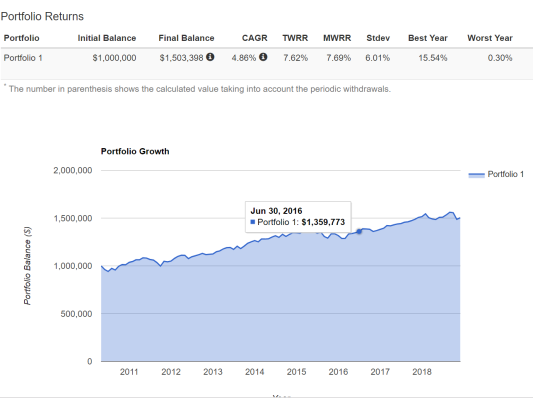

However, I was recently asked by a charitable organization to come work full-time (for free with only some expense reimbursements). I am going to do it. So, now I will be working harder and starting to use what I’ve planned so long to use. Fortunately, the last 8 years have allowed me to drop the required withdrawal rate to well below 3%. So, I should be just fine.

Funny how things work out . . .

We never would have thought of that.

We never would have thought of that.