Red Corvette

Dryer sheet wannabe

Hello,

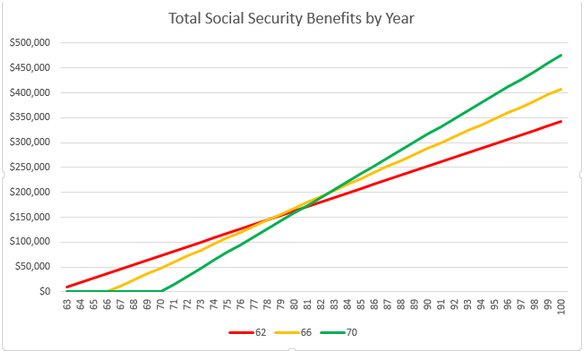

The estimates I have seen from the Social Security website for ages 62, 66 and 70 assume one is still working but if you retire at 62 and are no longer contributing is there still a benefit to waiting?

The estimates I have seen from the Social Security website for ages 62, 66 and 70 assume one is still working but if you retire at 62 and are no longer contributing is there still a benefit to waiting?