Mike,

Perhaps I'm not getting it, but what you and others describe above is inconsistent with opensocialsecurity.com results.

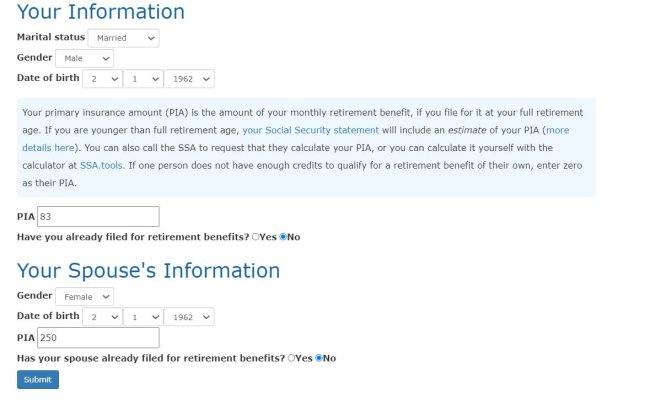

I input a hypothetical couple consistent with the scenario described above. Married and both born on 2/1/1962 so both currently 62 years old so their FRA is 67. Husband (lower earning spouse) has PIA of $83 and wife (higher earning spouse) has PIA of $250 (these are 1/12th of the example of PIAs of $1,000 for the husband and $3,000 for the wife so the output is in per month amounts).

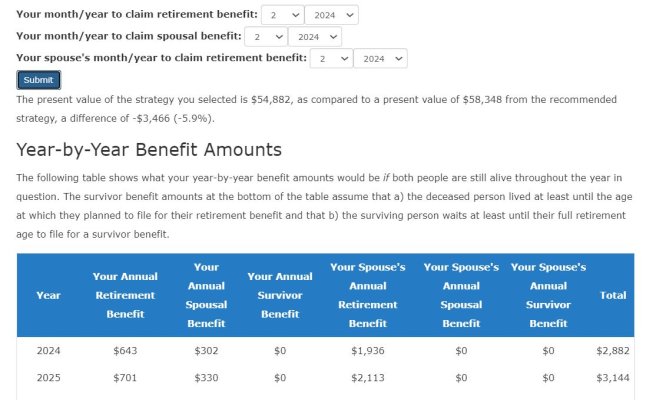

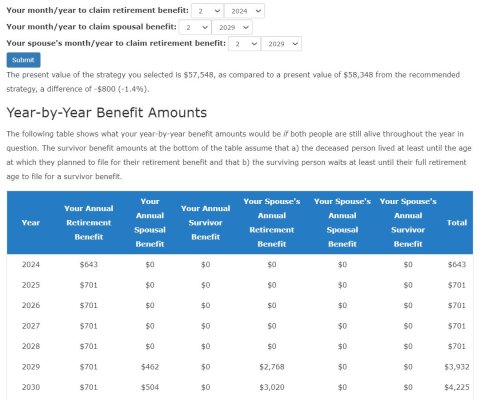

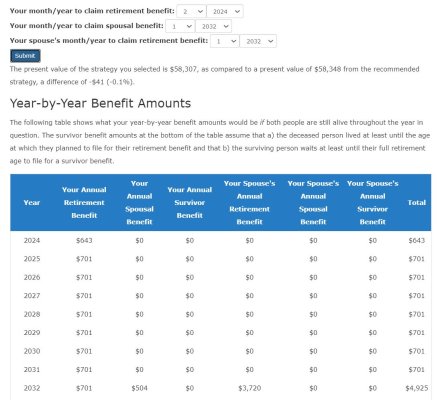

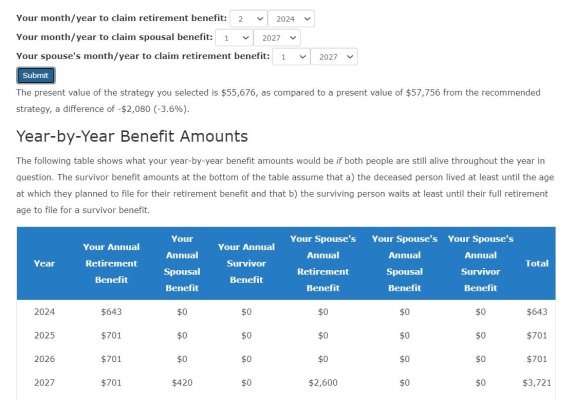

I ran 4 alternative claiming strategies. In each case the lower earning spouse, the husband with the $83/month PIA, files in 2/2024 at age 62. The higher earning spouse files at either 62, 65, 67 (FRA) or 70... or 2/2024, 2/2027, 2/2029 or 1/2032.

The results for the wife filing at 67 or 70 are consistent with what you wrote above. The lower earning spouse benefit is $1,200 consisting of $700 benefit based on their own work record (70% of $1,000) and a spousal benefit of $500 [($3,000*50%)-$1,000]. The higher earnings spouse's benefit at their FRA is $3,000 and at age 70 is 124% of their FRA or $3,720. That all makes perfect sense to me.

However, where the higher earning spouse files at 62, then the lower earning spouse's spousal benefit is only $330, so it is discounted from the $500... I presumed because the higher earning spouse filed at 62 rather than their FRA or 67 or later. The $330 is 66% of the $500 spousal benefit if the higher earning spouse files at 67 or later whereas the higher earning spouse's benefit is 70% of their PIA because they filed at 62 vs 67.

If I run a scenario where the higher earning spouse files at age 65 in 2/2027 then the spousal benefit is $420, 84% of the $500 and the higher earning spouse's benefit is $2,600, 86% of their PIA.

I realize that there are a few bucks floating around here and there but it seems that opensocialsecurity.com discounts the lower earning spouse's spousal benefit if the higher earning spouse files before their FRA... hence the confusion. Am I misinterpreting the opensocialsecurity.com's results or is it calculating the spousal benefit inconsistent with what you wrote above?

Below are screenshots of the opensocialsecurity.com output with the higher earning spouse filing at 62 (2/2024), 65 (2/2027), 67/FRA (2/2029) and 70 (1/2032).