Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I pre-ordered from Amazon, received last week and finished it yesterday. I would highly recommend this book by Laurence Kotlikoff & Scott Burns.

By way of background: I am a Bernstein, Bogle, Boglehead disciple. This book is just as credible but it's quite different and their conclusions differ in fascinating ways too. It also addresses more topics regarding the $ aspect of planning/retiring than any other book I have read.

The central theme is consumption smoothing. The goal is to maintain the same standard of living throughout your life - including avoiding a shift, up or down, in standard of living when you retire. They (pretty persuasively) contend that conventional tools will more often than not result in a (possibly radical) shift.

ESPlanner (Kotlikoff) is used for all the calculations and it is mentioned several times in the book. There is a brief sales pitch in the last chapter, but I would not characterize the book as simply an ESPlanner sales tool.

It is not written as an economic text book, it's an easy read, not intimidating at all. If you're hoping all the (ESPlanner) calculations will be spelled out in detail so you can enhance your personal spreadsheets or other tools, you will be disappointed. I am very good at developing Excel tools and I have an elaborate spreadsheet of my own. After reading this book, I am convinced there is no way I could ever do a spreadsheet that encompasses all the (real) variables, there are just too many. There are lots of scenarios examined, the results are shown (calculated by ESPlanner), but not the calcs.

I am sure it will be different for each reader, but the chapters that were most enlightening to me were Fire Your Job, Does It Pay to Play, Fire Your Broker (something we all know) and the last 10 chapters in Part V: Preserving Your Living Standard.

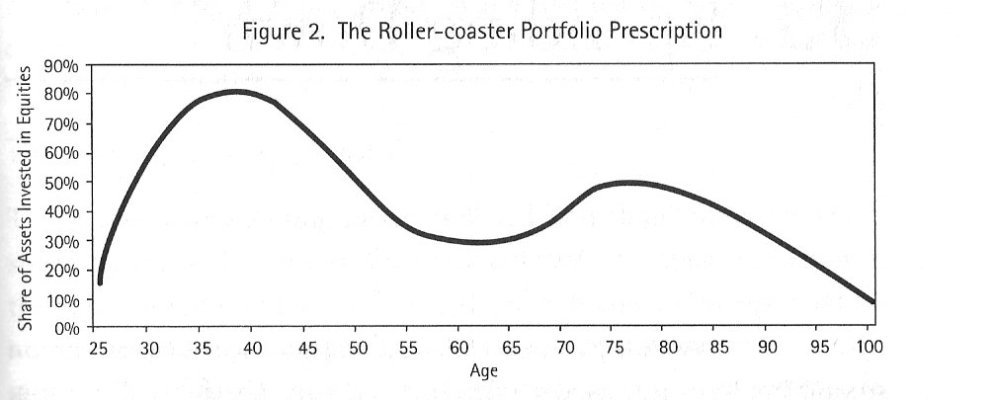

Again, I think it's a tremendously worthwhile, provocative read. From the perspective of an Economist vs just a Financial Advisor. Just one graph from the book (below) to pique your interest, I've never seen a recommendation like this (before you dismiss it, you'd have to read the explanation). My 2¢...

By way of background: I am a Bernstein, Bogle, Boglehead disciple. This book is just as credible but it's quite different and their conclusions differ in fascinating ways too. It also addresses more topics regarding the $ aspect of planning/retiring than any other book I have read.

The central theme is consumption smoothing. The goal is to maintain the same standard of living throughout your life - including avoiding a shift, up or down, in standard of living when you retire. They (pretty persuasively) contend that conventional tools will more often than not result in a (possibly radical) shift.

ESPlanner (Kotlikoff) is used for all the calculations and it is mentioned several times in the book. There is a brief sales pitch in the last chapter, but I would not characterize the book as simply an ESPlanner sales tool.

It is not written as an economic text book, it's an easy read, not intimidating at all. If you're hoping all the (ESPlanner) calculations will be spelled out in detail so you can enhance your personal spreadsheets or other tools, you will be disappointed. I am very good at developing Excel tools and I have an elaborate spreadsheet of my own. After reading this book, I am convinced there is no way I could ever do a spreadsheet that encompasses all the (real) variables, there are just too many. There are lots of scenarios examined, the results are shown (calculated by ESPlanner), but not the calcs.

I am sure it will be different for each reader, but the chapters that were most enlightening to me were Fire Your Job, Does It Pay to Play, Fire Your Broker (something we all know) and the last 10 chapters in Part V: Preserving Your Living Standard.

Again, I think it's a tremendously worthwhile, provocative read. From the perspective of an Economist vs just a Financial Advisor. Just one graph from the book (below) to pique your interest, I've never seen a recommendation like this (before you dismiss it, you'd have to read the explanation). My 2¢...

Attachments

Last edited:

I plan to ramp up my spending gradually, though, so that I don't go nuts with it and still recall what I believe to be important in life. Besides, moderation in all things.

I plan to ramp up my spending gradually, though, so that I don't go nuts with it and still recall what I believe to be important in life. Besides, moderation in all things.