Gearhead Jim

Full time employment: Posting here.

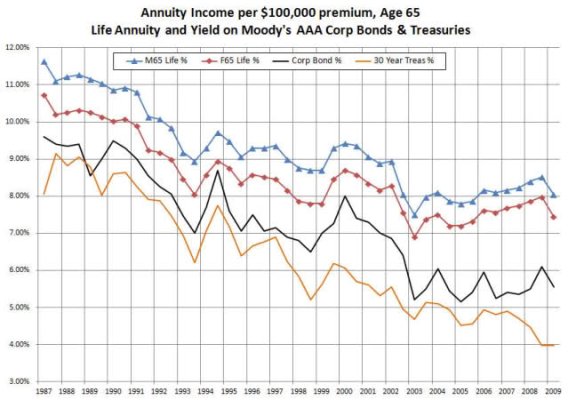

The monthly payout one gets from a SPIA should rise or fall somewhat with the insurance company's expectation of future rreturns. And I've been told those returns are mostly in the bond market. If so, SPIAs being sold today should have a significantly lower payout than ones issued 5-10 years ago.

Is that correct?

Can anyone give some actual comparisons between then and now? Like how much the monthly payout would be for a person who invested $100,000 at age 65 in 2005, and his brother who buys an identical annuity today?

Thanks!

Is that correct?

Can anyone give some actual comparisons between then and now? Like how much the monthly payout would be for a person who invested $100,000 at age 65 in 2005, and his brother who buys an identical annuity today?

Thanks!