ownyourfuture

Thinks s/he gets paid by the post

- Joined

- Jun 18, 2013

- Messages

- 1,561

My Mother cashed in series E savings bonds late in 2017. The interest was substantial, slightly over 18 K. I've never had any experience with savings bonds, but as I understand it, the interest earned is taxable @ the federal level, but not by the state. She knew this as well, but never made adjustments to her est. federal taxes to compensate. She also had 11k in RMD from her IRA.

She did a pencil return about a month ago & it was no surprise when it showed that she owed just over 5k to the feds, & was to get back around $30.00 from the state.

Last week I gathered up all her tax info, bought it home, & did a return using TurboTax deluxe.

The amount she owes the feds is the same, but the refund from the state that I came up with is $217.00 but…….. there’s also an underpayment penalty of $1.00 making the refund $216.00 ?

Is it possible to be due a refund, yet also have an under payment penalty ?

Obviously, the 1$ penalty is of no concern to us, we just want to be sure to file the right return. For what it's worth, turbo tax checked for errors, & said everything is 100% correct.

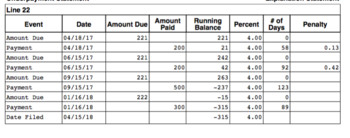

In case it could be helpful, here’s a screenshot of her fed & state tax summaries.

She did a pencil return about a month ago & it was no surprise when it showed that she owed just over 5k to the feds, & was to get back around $30.00 from the state.

Last week I gathered up all her tax info, bought it home, & did a return using TurboTax deluxe.

The amount she owes the feds is the same, but the refund from the state that I came up with is $217.00 but…….. there’s also an underpayment penalty of $1.00 making the refund $216.00 ?

Is it possible to be due a refund, yet also have an under payment penalty ?

Obviously, the 1$ penalty is of no concern to us, we just want to be sure to file the right return. For what it's worth, turbo tax checked for errors, & said everything is 100% correct.

In case it could be helpful, here’s a screenshot of her fed & state tax summaries.