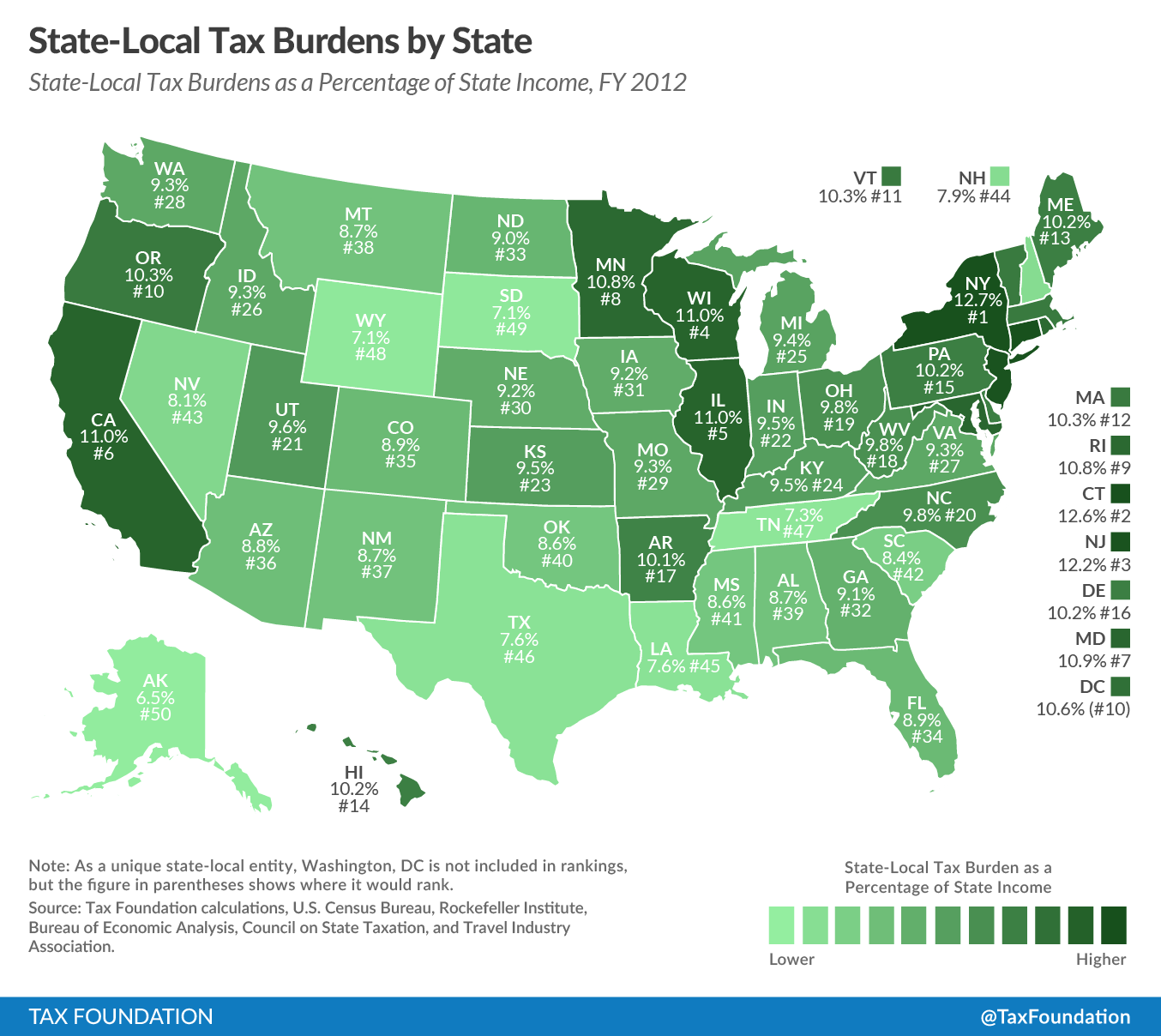

Are there sweet-spots to live in US to get lower taxes?

For instance, living in FL-no income tax, but living near a border state that may have lower sales tax. Or low real-estate tax in the state but a border state has low sales tax.

For instance, living in FL-no income tax, but living near a border state that may have lower sales tax. Or low real-estate tax in the state but a border state has low sales tax.