You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SWR race to the bottom

- Thread starter Focus

- Start date

There is a point that Wade, and others, ignore. Even if future equity and fixed income returns prove lower, they are still a better deal compared with annuities. That is, less money needs to be saved to finance the same annual spending at a 95% portfolio survival level. Their analysis is also static, they don't show the benefit of rebalancing a diversified portfolio.

Future equity and fixed income returns may be lower than we are expecting, but an annuity now doesn't seem to be of help.

Future equity and fixed income returns may be lower than we are expecting, but an annuity now doesn't seem to be of help.

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Do you know that this is exactly what ***** said many years ago, and incidentally has to be correct, no matter how popular or unpopular it is among the retired and retire wannabes at any given time?

***** got a bit florid about it, but there it was, long ago in these very forums.

Ha

***** got a bit florid about it, but there it was, long ago in these very forums.

Ha

Onward

Thinks s/he gets paid by the post

- Joined

- Jul 1, 2009

- Messages

- 1,934

I've seen historical CAPE data, and it does seem to have some predictive value.

But I just can't swallow the idea that earnings ten years ago have an effect on where the stock market will be 20 years from now.

But I just can't swallow the idea that earnings ten years ago have an effect on where the stock market will be 20 years from now.

In this paper I didn't see any reference to a solution, just an assumption that they can reliably predict future returns, and the oft mentioned 4% is likely to fail. In much of his other work, however, he has advocated annuities as a way to deal with the risk of portfolio failure.Is that what he's advocating, annuities?

The risk is real, I just don't see how Pfau offers any reasonable advice or options.

mickeyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

In this paper I didn't see any reference to a solution, just an assumption that they can reliably predict future returns, and the oft mentioned 4% is likely to fail. In much of his other work, however, he has advocated annuities as a way to deal with the risk of portfolio failure.

The risk is real, I just don't see how Pfau offers any reasonable advice or options.

If I am not mistaken, Wade Pfau is currently employed by The American College in Bryn Mawr, PA. They issue the CLU and ChFC designations as well as others. They are traditionally an insurance-based educational arm of the industry. Keep this in mind when annuities are a recommended solution to a problem. Just sayin...

enjoyinglife102

Recycles dryer sheets

- Joined

- Jan 6, 2013

- Messages

- 162

The 1.42% SWR would only be possible if the gov't measured CPI reflected your personal rate of inflation. Or, in general, the personal rate of inflation for aging, retired folks. At our house, it wouldn't work. Our personal rate of inflation has been higher than the gov't published CPI figures the past several years. Food, travel, medical....... all bringing up our costs beyond the gov't figures.

I'm always surprised this doesn't receive more attention and how the government CPI is so widely accepted. The inflation rate has such an enormous influence on all of these models and yet the amount used has no bearing on what any individual experiences; talk about a flawed model.

Cheer up, everyone some good news on the SWR front. Today I attended the July 4th banquet at the mobile home park where my mom lives. It is a nice park and a 55+ community and it has been in existence for around 40 years. There are perhaps 150 homes in there.

I asked several people, including a couple of folks who serve in formal elected offices for the park, how old was the oldest person still living in the park. They all said 90 years old (about 3 women this age or close). They couldn't think of any men that old still living there. So it looks like most of the older folks packed it in either to St. Peter or to a special care home . . . most of the other folks packed it in much earlier.

;-)

I asked several people, including a couple of folks who serve in formal elected offices for the park, how old was the oldest person still living in the park. They all said 90 years old (about 3 women this age or close). They couldn't think of any men that old still living there. So it looks like most of the older folks packed it in either to St. Peter or to a special care home . . . most of the other folks packed it in much earlier.

;-)

clifp

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 27, 2006

- Messages

- 7,733

But that isn't a 2.7% real return, is it? I'm not sure your comparison is apples-apples to TIPS?

Well since 80+% of the yield is from dividends and they historically increased at rate well above inflation. 10% of the rest is from inflation link bonds. I think it is an apples to apples comparison.

I also look at the M* Dividend newsletter which has a builder portfolio (dividend appreciation) with current yield of 3.3% and the harvest portfolio (high yield) with a 4.8% yield. Both portfolio have increased income at a rate faster than inflation. In particular a $1 million portfolio back in Aug 2005 would have an income of $36,552 and would now have an income of $59,020 and value of ~$1.8 million. Now this does include reinvestment of dividends. But even assuming a 45K average distribution for 8 years. would still leave an income of $47,216

ER Eddie

Thinks s/he gets paid by the post

- Joined

- Mar 16, 2013

- Messages

- 1,788

Cheer up, everyone some good news on the SWR front. ... I asked several people, including a couple of folks who serve in formal elected offices for the park, how old was the oldest person still living in the park. They all said 90 years old (about 3 women this age or close). They couldn't think of any men that old still living there. So it looks like most of the older folks packed it in either to St. Peter or to a special care home . . . most of the other folks packed it in much earlier.

;-)

So, cheer up, because you'll be dead in the next few decades?

It seems like many on this board are planning for 100 year life spans and are worried about the SWR for that . . . probably no need to worry in reality . . .So, cheer up, because you'll be dead in the next few decades?

ER Eddie

Thinks s/he gets paid by the post

- Joined

- Mar 16, 2013

- Messages

- 1,788

Yes, indeedy.

Give me another 20 years and I'm out.

Give me another 20 years and I'm out.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

It seems like many on this board are planning for 100 year life spans and are worried about the SWR for that . . . probably no need to worry in reality . . .

I think those of us with parents and/or grandparents that lived to be 100 or so have to plan for at least that long.

ER Eddie

Thinks s/he gets paid by the post

- Joined

- Mar 16, 2013

- Messages

- 1,788

I like the fact that I'll only live to 80 or so, probably less. It makes financial planning easier. I don't need to keep my principal intact. I'm single, no kids, so it's okay if I deplete the principle. I'm hoping to keep it intact for the next decade or so. But after that, f*ck it.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

"Probably" is the key word there. Planning for the "worst" case that can still reasonably happen makes sense to me. Living to 100 is not likely but yet not unreasonable for me. I do not want to be unprepared for that case.It seems like many on this board are planning for 100 year life spans and are worried about the SWR for that . . . probably no need to worry in reality . . .

shotgunner

Full time employment: Posting here.

- Joined

- Jun 18, 2008

- Messages

- 534

I grew up in the town where I live. I read the obits every day in the local paper, I have seen a lot of 50 and 60 something obits, very very few 100 or 100+. I Semi-ER'd because I thought the possibility of dying before experiencing some freedom was what was most important to not let happen. Look around folks, there are ton (if not the majority) of people around you who will never enjoy having the amount of money a person who is interested in participating in this site has. They will still get by, so will we. Those who paint the future as bleak are wrong but they play well to fear, a powerful human emotion.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

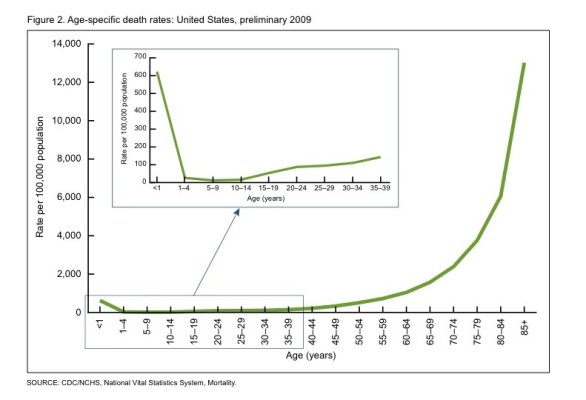

Too bad your observation is misleading, but you're welcome to join the "proof by exception" club, it's a large group. Odds are, "a ton" more of us will live a long life despite the unfortunate exceptions. No matter how many times data is shared here from multiple sources (CDC this time)...I grew up in the town where I live. I read the obits every day in the local paper, I have seen a lot of 50 and 60 something obits, very very few 100 or 100+. I Semi-ER'd because I thought the possibility of dying before experiencing some freedom was what was most important to not let happen. Look around folks, there are ton (if not the majority) of people around you who will never enjoy having the amount of money a person who is interested in participating in this site has. They will still get by, so will we. Those who paint the future as bleak are wrong but they play well to fear, a powerful human emotion.

Attachments

Last edited:

shotgunner

Full time employment: Posting here.

- Joined

- Jun 18, 2008

- Messages

- 534

Your CDC chart may be misleading, because it blends sexes and races. Men clearly live shorter lives on average and being a single male I only have to worry about me. The obits I read every day show a trend, very few 90+ old men. So did my daily visits to a large nursing home when my father was there. Very few men in the home by the way compared to women. I think one's ancestors give a greater indication of one's potential for longevity than any study of the masses. Males in my family have historically checked out between 52 and 83 and all but one went before 80 for 3 generations. Cures for the afflictions that took them still do not exist. Women in general have to be concerned with longevity cost more so than men and from a planning perspective a single male and a single woman is comparing apples to oranges.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

Too bad your observation is misleading, but you're welcome to join the "proof by exception" club, it's a large group. Odds are, "a ton" more of us will live a long life despite the unfortunate exceptions. No matter how many times data is shared here from multiple sources (CDC this time)...

It would have been interesting to see the chart broken down into 5 yr. segments after 85 to 100, instead of lumped together. My guess the line would plummet downward at 90.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Why speculate when data is readily available online Actuarial Life Table? Fortunately people who die in their "50 and 60 somethings" are a small group compared to those in the 70s and beyond. The shorter lifespan exceptions that some members choose to highlight while undoubtedly true, are relative exceptions and therefore not a sound basis for retirement planning (unless perhaps the exceptions are within your family). The data suggests most of us should plan on 85-95...

Sex and race shift the distributions, but most of us will enjoy a longer life...

Sex and race shift the distributions, but most of us will enjoy a longer life...

Attachments

Last edited:

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

The problem is if you don't plan for 100 and you do live that long, what is your plan B? It would be tough to go out and get a job at age 95.

I feel better having a plan that doesn't assume drawing down my money to zero at 90. I would rather live more frugal now and not have to worry about the future.

I feel better having a plan that doesn't assume drawing down my money to zero at 90. I would rather live more frugal now and not have to worry about the future.

explanade

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 10, 2008

- Messages

- 7,442

The problem is if you don't plan for 100 and you do live that long, what is your plan B? It would be tough to go out and get a job at age 95.

I feel better having a plan that doesn't assume drawing down my money to zero at 90. I would rather live more frugal now and not have to worry about the future.

Everyone here is for LBYM but there's also something to be said for spending money when you can do some things which you presume you won't be able to do later in life.

Katsmeow

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 11, 2009

- Messages

- 5,308

The problem is if you don't plan for 100 and you do live that long, what is your plan B? It would be tough to go out and get a job at age 95.

I feel better having a plan that doesn't assume drawing down my money to zero at 90. I would rather live more frugal now and not have to worry about the future.

This is true, but everyone still has to draw a line somewhere. And, it has to be considered as part of the overall planning.

That is, it is easy to say that one will plan to have enough money to last to say age 80 or 85. But, not many people will feel that they have to plan to age 110.

The other thing is certainty. That is I might want to feel 100% certain (although I think there is no such thing as 100% certainty) that the plan will work to age 80 but I might feel fine with a little bit less certainty that the plan will work to age 95 or age 100 and I may not put any effort at all into making sure the plan will work to 110.

The other thing is that when people want a plan that will work for 30 years or 40 years, etc. I always feel that this is really just a proxy for saying that you want a plan that will work for the rest of your life.

So, let's say you are happy with a plan that is 95% for 35 years taking you to age 95. That doesn't mean you have a 5% chance that you will run out of money before you die. Your actual chance of running out of money before you die is well below 5% because most people don't live to be 95.

This is why you see people with withdrawal rates that are higher than what most people here would think prudent and yet they do fine. That is, they die 20 years into their plan and so it doesn't end up mattering that their plan wouldn't have survived for 30 years.

mickeyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

like the fact that I'll only live to 80 or so

I bet you change your tune when you are age 79.

Similar threads

- Replies

- 53

- Views

- 6K

- Replies

- 5

- Views

- 605