Thanks for the help. The IRS pub didn't cover this situation, although it should have.

Yes, she's attending through May 2009. So it was billed in 08, I paid in 09, and she's attending in '09. It's pretty clear cut, but the thing that bothers me is that the entire amount from the 1098T is going on this year's tax return. So how can I use it for next year's as well?

OK, I've got you now. This is just amazing to me. Your situation may be somewhat uncommon, but it certainly is not unpredictable or out-of-this-world unusual. The instructions should cover this. The fact that in 86 pages, they can't cover a situation that one of our forum members found himself in, when he was in no way trying to go out of his way to complicate things, just trying to take a widely used and widely publicized tax credit, is just mind boggling. This should be routine and simple.

The fact that it is not says a lot about how bad our tax code is.

I don't know the answer, but it sure seems like you should be able to split the credit across two years, as she is attending school in each of those two years and your payments were made in each of the tax years.

On one hand, you should just do it. It seems right, it seems fair, it seems to match the *intention* of the rule (if I am decoding it right, I think I am).

OTOH, any mismatch in numbers tends to raise a flag - those are easily spotted by automated systems. And this is what you would have. I think it is likely to trigger an audit (which may be no more than a request for documentation, not a full blown line-by-line review of the whole 1040).

It's too bad that an honest taxpayer gets hit with that decision.

On the more constructive side of things: Can you get the school to re-issue the 1098-T with the "AMOUNT PAID" box filled in? There must be a reason they provide that box - maybe this is it? I think that would solve it, then your numbers would match, right? And you would request one for 2009, with just an amount paid I guess. I dunno. That might raise other flags....

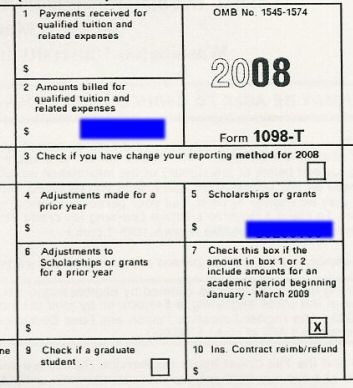

(Note the two typos on the 1098T "Check if you have change your reporting method..." and "check this box if the amount in box 1 or 2 include amounts...")

Geez, T-Al, with the thousands of forms they produce, you gotta expect a few typos, right? Hmmm, another sign of how bad this is - there *are* thousands of forms.

I had to dig through some forms in detail last night. In TAx ACt online, you go to a page with all the forms listed. I found myself scrolling through page after page of small font listings of forms to find the one I needed And you don't know if they called it "Schedule D worksheet", or "Capital Gains worksheet", or "Qualified Dividends and Capital Gains Worksheet", so that makes scanning for it tougher too.

I realized that the fact that I'm scanning through all these forms is a real sign of what a mess we have on our hands. It should not be like this.

Well, I should get back to my taxes. Later, I'm going to post another apparent "unintended consequence" of these stupid, inter-related counter productive rules. The short version is, a family with two kids one year apart in college can have a different tax bill from a family with kids two years apart in college, with all else equal. Now, why in the world would we want that to be the case? Makes no sense, does no good. Arghhhh.

-ERD50