FiveDriver

Full time employment: Posting here.

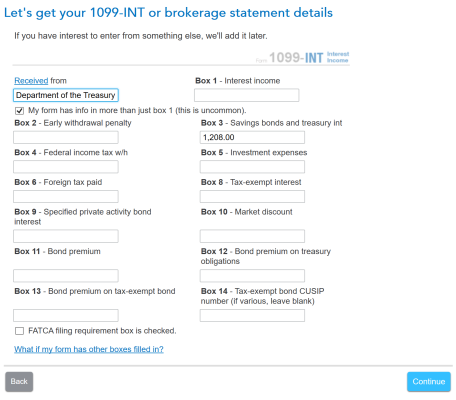

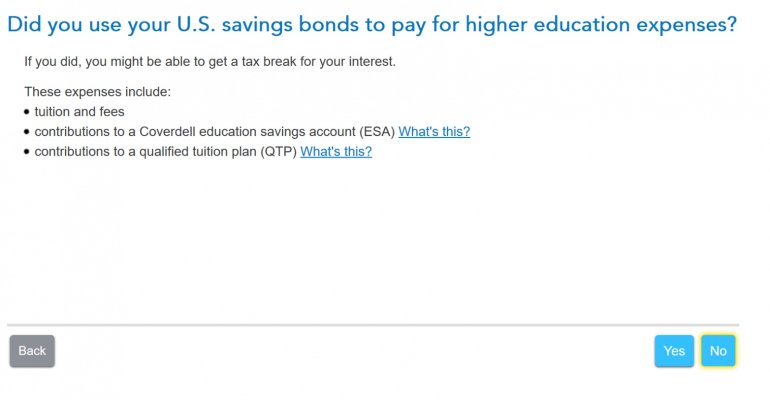

My Deluxe download version doesn't appear to recognize the sale of US E Bonds used for Higher Education. We've received a 1099-INT from the sale at our TD Bank and used these proceeds to pay for DD's Tuition.

I'm looking around in the TT Interest category, but I don't see a path to Schedule B or the Form 8815 to make the sale Tax Exempt.

Has anybody else run into this issue ??

I'm looking around in the TT Interest category, but I don't see a path to Schedule B or the Form 8815 to make the sale Tax Exempt.

Has anybody else run into this issue ??

Last edited: