ownyourfuture

Thinks s/he gets paid by the post

- Joined

- Jun 18, 2013

- Messages

- 1,561

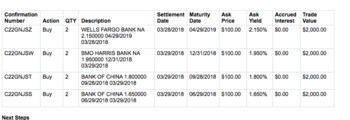

Yesterday morning I was setting up a 12 month cd ladder @ fidelity.

I was just about to complete the order, when I remembered that the feds were going to make a decision on interest rates that afternoon. (+.25)

I checked the rates for the 1 year ladder just now & there's no change.

Would it pay to wait a week or 2 & see if those rates go up, or is the 1/4 point hike already ‘priced in’ ?

I was just about to complete the order, when I remembered that the feds were going to make a decision on interest rates that afternoon. (+.25)

I checked the rates for the 1 year ladder just now & there's no change.

Would it pay to wait a week or 2 & see if those rates go up, or is the 1/4 point hike already ‘priced in’ ?