pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Same here.

+3

Same here.

The math works the same, instead of 96k, you'll have way more. My thing is why leave money on the table. You and your employers paid the government for this benefit. This has been deducted from your checks. For me I will have 44 yrs of investing into SS when I retire @ 60. If you die the government keeps YOUR investment. They key work is that if you don't need it before 70 you've done well and most likely won't run out of money. My difference between $886 from 62-70. If I take at 62 by 70 I will have 187K, at 70 I can draw 2800.00, if I withdraw 886.00 per month it will take 21 years to deplete 187K that puts me at 91yrs old

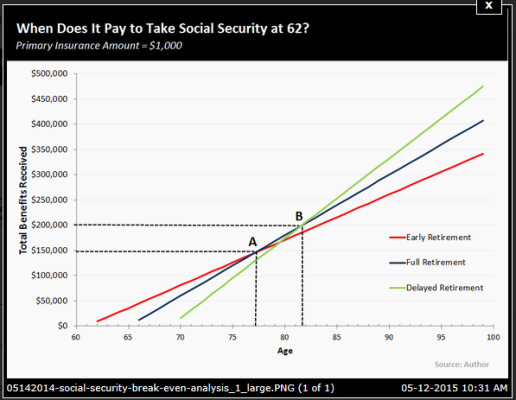

You messed up your numbers somewhere. The break-even point between 62 and 70 is in your early 80s..... the BEP is long before 91.

I don't have to invest it. If I take payments at 62 place, it in a savings account or jar in my back yard I will collect 187K by the time I'm 70. Continue drawing 1950.00 per month take 886.00 out of my jars( money I already collected) equals $2836 the same amount I would collect at 70. Divide 886 into 187K gives me 17.5 yrs before being 187k is exhausted that's not even including simple bank interest. Break even points only take into consideration if I take at 62 or 65 and use the money, when will it be a lost of income. I'm looking at not needing the money but taking it and banking it.

It's not all about inheritance, the difference between 62 and 70 is less than couple hundred a month. If you don't need the money invested it and the difference of 14k will be almost even. Why leave money on the table if you die before 70 all you hard work will be for nothing. If you don't need it before 70 I highly doubt you'll be short of money. Even at minimum your retirement is 12K a year that's 96k in 8 yrs that can be invested, even at bank rate it will be over a 100k. If you wait and collect 15K a years at 70, that's it. I take it at 62 still get 12k a year but have a bonus 100k in the bank to use. You hold out for 300.00 extra a month, if I take out 300.00 a month from my 96k saved it will take me 26.6 yrs without interest to deplete the 96K.

Even if your math was right, and it's not, your point would only be valid if all you're talking about is the absolute SS dollars. But there are many other factors that people other than yourself may be taking into consideration. If you add in the dollars saved by working around ACA costs, Roth conversions, and other possible factors it will change the math significantly. And the peace of mind of a higher survivor benefit for a spouse may not even be quantifiable. This is a complicated subject.

On the SS page mine show 1950.00 (62) and 2836.00 (70). Doesn't matter I'll be taking @62. It's my money, were all playing numbers with odds, there's no guarantee how long we'll live. Planning your life expectancy is like playing the Lotto you never know what the numbers are. I plan on retiring in 6yrs or sooner currently 53 who knows I could be dead by then.

That is really odd. Your age 70 benefit is 145% of your age 62 benefit.

My age 70 benefit is 175% of my age 62 benefit per my SSA statement.

My age 62 benefit is 74.6% of my FRA benefit, which is typical. My age 70 benefit is 130.7% of my FRA benefit... which is spot on.. 3 years and 10 months or 3.833 years times 8% a year is 30.7%.

130.7%/74.6% = 175%

At your age, your age 62 benefit would be 70.42% of your FRA benefit and your age 70 benefit would be 124% of your FRA benefit (+8% a year for 3 years)... so your difference would be 176% (124%/70.42%)... not 145%.

See https://www.ssa.gov/oact/quickcalc/early_late.html for details.

If the difference is $1,482 rather than $886 would that change your decision?

Note that in addition one needs to consider possible RMDs in deciding. If significant then taking SS earlier than 70 makes sense if the RMDs are going to be significant.

Note that in addition one needs to consider possible RMDs in deciding. If significant then taking SS earlier than 70 makes sense if the RMDs are going to be significant.

As RMD values are spelled out by the IRS, could you define "significant", please?

omni

Money is fungable, and also by starting SS at 65 your part B is deducted before the SS money starts. It all depends on the relative sizes of SS and RMDs. If RMDs are larger than SS then taking it early is a good thing, and you won't miss the additional SS payments. So as is stated it depends on your personal/family situation. (Being single in my case simplifies this)If RMD's are significant, wouldn't one take TIRA earlier than 70 and delay SS to 70?

If they push you into a higher tax bracket then taking the SS earlier would be a win, since the RMDs only increase as you age.

It depends somewhat on what rate of growth you expect as to how RMDs grow or shrink, but the percentage to withdraw starts by dividing the amount in the account by 27.4 the first year, this decreases to 22 by 76 17.9 by 81, 14.1 by 86 etc. So in all likelihood (unless the market goes into a 2008/2009 style decline your RMD will increase year by year as the divisor gets smaller.The RMD % increases but not necessarily the RMD$ amount. So if the SS and TIRA monies are interchangeable, why not reduce the TIRA subject to RMD's by taking it earlier instead of taking the SS earlier?

Edit - ok I see your new post.

It depends somewhat on what rate of growth you expect as to how RMDs grow or shrink, but the percentage to withdraw starts by dividing the amount in the account by 27.4 the first year, this decreases to 22 by 76 17.9 by 81, 14.1 by 86 etc. So in all likelihood (unless the market goes into a 2008/2009 style decline your RMD will increase year by year as the divisor gets smaller.

Note that in addition one needs to consider possible RMDs in deciding. If significant then taking SS earlier than 70 makes sense if the RMDs are going to be significant.

I think if you look at the actual SS cash flow, there is no "investment".The math works the same, instead of 96k, you'll have way more. My thing is why leave money on the table. You and your employers paid the government for this benefit. This has been deducted from your checks. For me I will have 44 yrs of investing into SS when I retire @ 60. If you die the government keeps YOUR investment. They key work is that if you don't need it before 70 you've done well and most likely won't run out of money. My difference between $886 from 62-70. If I take at 62 by 70 I will have 187K, at 70 I can draw 2800.00, if I withdraw 886.00 per month it will take 21 years to deplete 187K that puts me at 91yrs old

Individual date of death can't be predicted for people who are currently in normal good health.Data for survival rates take in genetics, a fatal accident either your fault or some else can't be calculated.

If you follow the 4% guideline, you can spend more in the early years of retirement if you defer your SS start date.Well, no. Actually that higher SS at 90-95 just means I can go to Monaco for 8 weeks a year instead of merely 7.

What's a few extra $$ going to buy you at 95? A better grade of gruel in the nursing home?

That's not my plan.

The plan is not to just barely get by. The plan is for the SS benefit to be lost in the roundoff.