FUEGO

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 13, 2007

- Messages

- 7,746

I just finished reading the Ultimate Dividend Playbook by Josh Peters. Overall I was unimpressed. But it could be a worthwhile read for some.

A big part of my disappointment stems from the fact that the book is geared towards individual security selection (focusing on dividends and dividend growth) instead of the bigger picture of dividend investing. I have a general policy to not invest in individual securities. Single stock risk is easily diversified away and one of the few "free lunches" on Wall Street.

I would have liked to read more of how a mutual fund investor could structure a dividend oriented portfolio (ie - what to expect, what history would have provided for me, realistic expectations of future dividends/growth, etc). Maybe discuss a few of the existing dividend oriented mutual funds and weigh pros/cons.

The book does hold some promise for those looking to pick individual securities and build a dividend rich portfolio. The book describes a way to look at stock fundamentals and how they impact dividends (dividend safety, payout ratio, dividend growth potential based on return on equity, etc). The author presents his own "Dividend Drill Return Method" of analyzing dividend paying stocks.

Overall, I thought the author was guilty of showing his winners and his past glories and came short on illustrating his many failures (which I assume he has had), and why he was wrong. To be fair, he does cover a fair number of wrong bets, but he does a good job of attributing successful bets to his clever analysis and attributing failures to bad luck or things just not going his way.

I really got the feeling from reading the book that the author makes individual security analysis a lot simpler than it really is. He even says it is simple! To quote from page 25: "Wall Street has an army of professionals determined to make investing seem like rocket science". And then he goes on to suggest that dividend investing isn't that difficult.

He disregards diversification as an irrelevant consideration, as far as I can tell. He doesn't go as far as saying "Diversification - ha! - more like Diworsification, am I right am I right", but I can imagine him saying it.

Around one third of the book is appendix material covering a number of topics. Of interest is an explanation of the fundamentals of banks, REITS, master limited partnerships, and utilities (all typically high-yielding dividend payers).

The author is apparently editor of the DividendInve$tor newsletter from Morning$tar. In the book, he shows his "Dividend Harvest Portfolio" that is intended to provide high current income (~5-7% if I recall correctly) and dividend growth around the rate of inflation. The portfolio is presumably actively managed and updates are provided in the dividendinvestor newsletter (that you pay for).

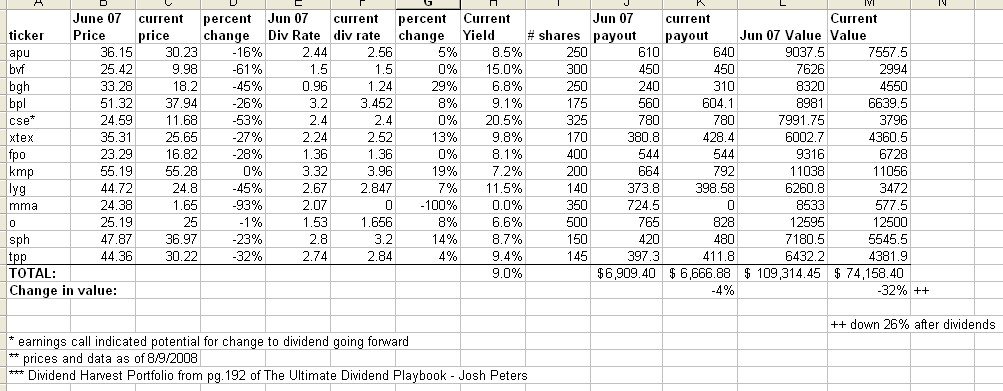

Just for kicks, I took his June 2007 portfolio from the book and looked at it today to see what it is worth and what it is yielding (spreadsheet is attached showing my analysis). He's down 32% in about 1 year (well, only down 26% if you include dividends). The June 2007 portfolio was worth $109,000. Today it is worth $74,000 plus about $6800 in dividends it paid out over the last year.

His dividend payout on his model portfolio is down from $6900 to 6700 this year (not only losing out after inflation, but also losing out before inflation). One of his holdings (out of only 13) is in the pink sheets, presumably close to bankruptcy (and has suspended its dividend). Another holding has stated that future dividends stand a good chance of being "revised". The payout ratio of all but 2 of the stocks exceed 100% of trailing twelve months earnings (he says that is a sign that dividends may be in trouble). The portfolio is highly concentrated (I think 12 out of 13 positions are in energy or financials).

One caveat is that I have no clue what additions/subtractions he has made in his dividendinvestor newsletter since June, 2007. Maybe he recommended selling all the losers and buying better stocks?? But I find it shocking that his picks would have done so poorly, even given the general downturn in the market. Looking at the 4-5 dividend-oriented funds at Vanguard, they are only down between 5-13% over the last 12 months versus 26% down in the Dividend Harvest portfolio. Admittedly, he was shooting for significantly higher yields than the 3-3.5% being paid out by Vanguard dividend funds.

Anyone follow his dividendinvestor newsletter ($149 per year )? Did the model portfolio actually do better than I'm suggesting here?

)? Did the model portfolio actually do better than I'm suggesting here?

I'd also like to ask if anyone else has suggestions for any books on dividend investing for mutual fund investors like me? I like the idea of getting a 4% or so yield from dividends that I can rely on and that will keep pace with inflation.

A big part of my disappointment stems from the fact that the book is geared towards individual security selection (focusing on dividends and dividend growth) instead of the bigger picture of dividend investing. I have a general policy to not invest in individual securities. Single stock risk is easily diversified away and one of the few "free lunches" on Wall Street.

I would have liked to read more of how a mutual fund investor could structure a dividend oriented portfolio (ie - what to expect, what history would have provided for me, realistic expectations of future dividends/growth, etc). Maybe discuss a few of the existing dividend oriented mutual funds and weigh pros/cons.

The book does hold some promise for those looking to pick individual securities and build a dividend rich portfolio. The book describes a way to look at stock fundamentals and how they impact dividends (dividend safety, payout ratio, dividend growth potential based on return on equity, etc). The author presents his own "Dividend Drill Return Method" of analyzing dividend paying stocks.

Overall, I thought the author was guilty of showing his winners and his past glories and came short on illustrating his many failures (which I assume he has had), and why he was wrong. To be fair, he does cover a fair number of wrong bets, but he does a good job of attributing successful bets to his clever analysis and attributing failures to bad luck or things just not going his way.

I really got the feeling from reading the book that the author makes individual security analysis a lot simpler than it really is. He even says it is simple! To quote from page 25: "Wall Street has an army of professionals determined to make investing seem like rocket science". And then he goes on to suggest that dividend investing isn't that difficult.

He disregards diversification as an irrelevant consideration, as far as I can tell. He doesn't go as far as saying "Diversification - ha! - more like Diworsification, am I right am I right", but I can imagine him saying it.

Around one third of the book is appendix material covering a number of topics. Of interest is an explanation of the fundamentals of banks, REITS, master limited partnerships, and utilities (all typically high-yielding dividend payers).

The author is apparently editor of the DividendInve$tor newsletter from Morning$tar. In the book, he shows his "Dividend Harvest Portfolio" that is intended to provide high current income (~5-7% if I recall correctly) and dividend growth around the rate of inflation. The portfolio is presumably actively managed and updates are provided in the dividendinvestor newsletter (that you pay for).

Just for kicks, I took his June 2007 portfolio from the book and looked at it today to see what it is worth and what it is yielding (spreadsheet is attached showing my analysis). He's down 32% in about 1 year (well, only down 26% if you include dividends). The June 2007 portfolio was worth $109,000. Today it is worth $74,000 plus about $6800 in dividends it paid out over the last year.

His dividend payout on his model portfolio is down from $6900 to 6700 this year (not only losing out after inflation, but also losing out before inflation). One of his holdings (out of only 13) is in the pink sheets, presumably close to bankruptcy (and has suspended its dividend). Another holding has stated that future dividends stand a good chance of being "revised". The payout ratio of all but 2 of the stocks exceed 100% of trailing twelve months earnings (he says that is a sign that dividends may be in trouble). The portfolio is highly concentrated (I think 12 out of 13 positions are in energy or financials).

One caveat is that I have no clue what additions/subtractions he has made in his dividendinvestor newsletter since June, 2007. Maybe he recommended selling all the losers and buying better stocks?? But I find it shocking that his picks would have done so poorly, even given the general downturn in the market. Looking at the 4-5 dividend-oriented funds at Vanguard, they are only down between 5-13% over the last 12 months versus 26% down in the Dividend Harvest portfolio. Admittedly, he was shooting for significantly higher yields than the 3-3.5% being paid out by Vanguard dividend funds.

Anyone follow his dividendinvestor newsletter ($149 per year

I'd also like to ask if anyone else has suggestions for any books on dividend investing for mutual fund investors like me? I like the idea of getting a 4% or so yield from dividends that I can rely on and that will keep pace with inflation.