Ready

Thinks s/he gets paid by the post

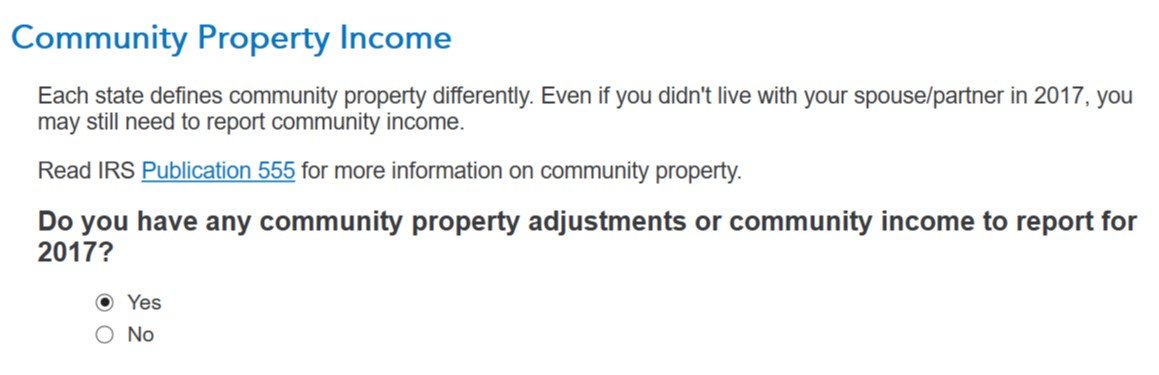

This is a new one for me. Taxcut is requiring me to fill in form 8958 because I'm married filing separately. It appears to be a requirement for married filing separately in community property states. However we've been filing this way for four years now and this is the first time it's come up. Does anyone have any idea on why this is happening to me? Is it a new rule? If not, why didn't the prior three years of Taxcut and Turbotax software we used mention it?