I'd be delighted for you to run the FireCalc. Thanks for taking the time. Hope guests on this forum will benefit as well.

Goldenmom,

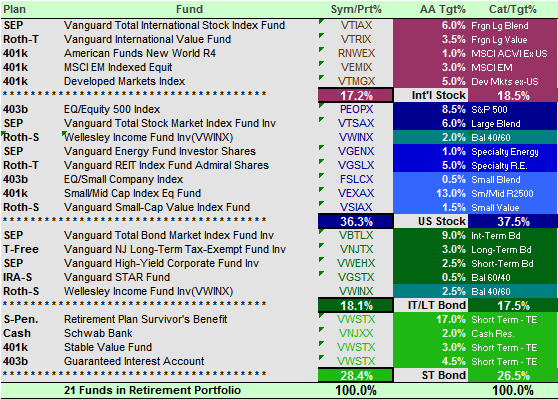

As previously mentioned, I recommend that you step back from consideration of individual funds right now and instead look at the big picture—your desired withdrawal strategy and rate, some consideration of macro asset allocations (e.g. approx percentage in bond, stocks, “cash” etc).

FIRECalc is a >great< tool for just trying things out. It’s got many decades of data from the most significant asset classes. It doesn’t have

everything , e.g. good long-term historical data on emerging market stocks just doesn’t exist, FIRECalc doesn’t break down the US market into the smallest of subcategories, etc. But you really don’t need any of that. FIRECalc can help you answer this very big question: “Over the entire modern history of equity markets, if I had invested my money in X mix of assets and if I had withdrawn it using X method, what would the results have been?”

I strongly urge you to go to the link and spend some time trying out various withdrawal methods and asset mixes. Don’t try to optimize the mix to the nearest nit--understand that the future won’t be exactly like any of these past sequences.

So, here’s something to get you started. We’ll start with the “given” that your portfolio is $800K and that you are interested in a 35 year timeframe (when your husband will be 105). You’ve said that your baseline requirement might be $12K per year in withdrawal from the portfolio, though circumstances could change and you’d need more.

Approach: Fixed withdrawals adjusted annually for inflation. Very predictable withdrawal amounts, but if the withdrawal rate exceeds the growth rate of the portfolio, it can go to zero.

[FONT="]

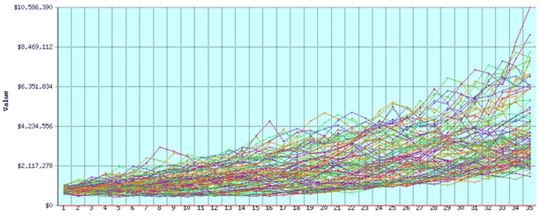

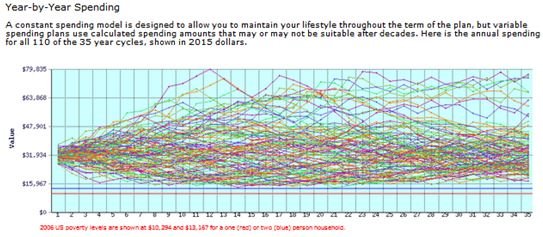

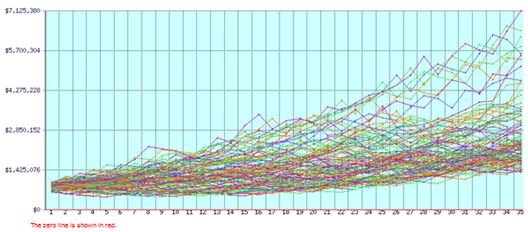

Scenario 1: $12K starting withdrawal, invested 100% in 5 year US Treasuries. Treasuries are a very safe investment. The chart below shows that there was not a single case in the 110 different starting years when the portfolio would have gone broke supporting this level of spending. In fact, the historic success rate for 35 years (invested in 100% 5 year US treasuries) would still be 100% if the withdrawals had started at $27k per year, though the average ending balance would be a lot less. Now, we know that Treasuries today aren’t yielding very much above inflation, but this isn’t the first time that has happened, either. In every previous case, they would have supported the given level of spending with the given starting balance—that’s good to know. (click on the graph to enlarge it. Also note that the scales on the various charts are not the same, so you'll need to look at the [FONT="]labe[FONT="]ls[/FONT][/FONT]). Don't get bogged down looking at individual lines, the important thing is the general trend and the extremes.

[/FONT]

[FONT="]

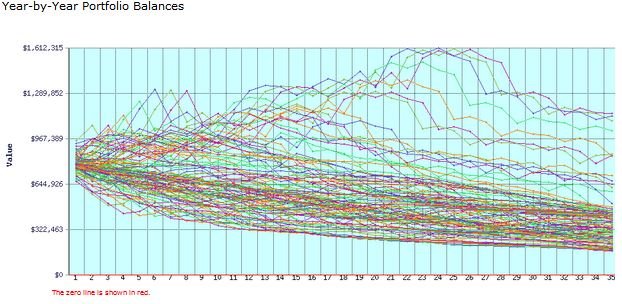

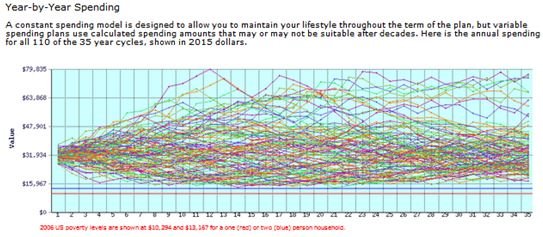

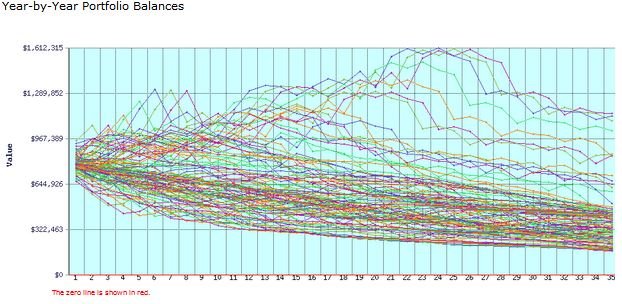

Scenario 2. Fixed $12K withdrawals (adjusted for inflation) from a portfolio of 50% US Stocks and 50% 5-year Treasuries. The graph below shows the results of 110 different starting years at this asset mix and withdrawal rate. It had a 100% success rate. The average ending balance is about 2.6 million (present year) dollars. The success rate remained at 100% at a starting withdrawal value of up to $28K per year. So, compared to 100% treasuries, having half the portfolio in stocks improved the average ending balance >and< allowed (slightly) higher withdrawals with the same 100% historical portfolio success rate. Did stocks increase the annual volatility of the portfolio—yes. Did that matter at all? It doesn’t seem that it did--no increase in "failures", slightly higher withdrawals supported.

[/FONT]

Variable withdrawals: Let’s assume that you are willing to vary the amount that you take out of the portfolio every year based on how well it has done, rather than sticking with a fixed withdrawal amount. In the real world, most people would probably do this—tightening their belts if their investments are down, and taking that nicer vacation if the portfolio is gaining against inflation. With your $800K portfolio and a need to spend only $12K per year, you would have a withdrawal rate of just 1.5%. As a general reference, most people on this site are probably planning to withdraw between 2.5% and 5% per year, so your “baseline” withdrawal rate is

very conservative. We already saw that very conservative investments have historically been sufficient to meet that $12K requirement. But if your spending requirements/desires went up (medical costs, a desire to travel, etc), what would historically have been safe?

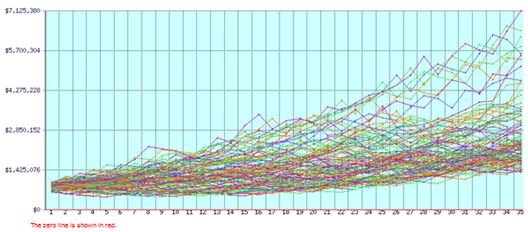

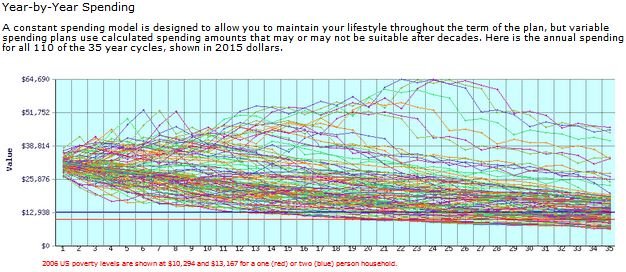

Scenario 3: Withdraw 4% of end-of year balance each year, “95% rule”, invested in 50% 5 year Treasuries, 50% total US stock market: Each year you’d withdraw 4% of your portfolio balance (so, $32K in the first year),

or 95% of the amount you withdrew the previous year (whichever is greater).

The graph below is different from the ones above, it doesn’t show account balances, it shows the amount we would be withdrawing under this rule, and the amounts are adjusted for inflation (so, everything is in 2015 dollars). You can see that, historically, 50% stock/50% treasuries portfolio starting at $800K would have supported 4% withdrawals and in no case would annual withdrawals dipped below the $12k baseline you’ve described. FIRECalc also shows the graph of annual account balances, I just didn’t include it here, but the average ending portfolio value after 35 years was $853K. Since this is inflation-adjusted to 2015 dollars, we can see that portfolio generally did a good job of supporting this withdrawal rate while not being drawn down.

[FONT="]

Scenario 4

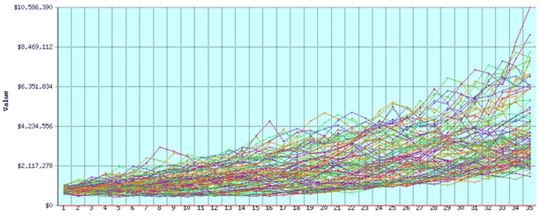

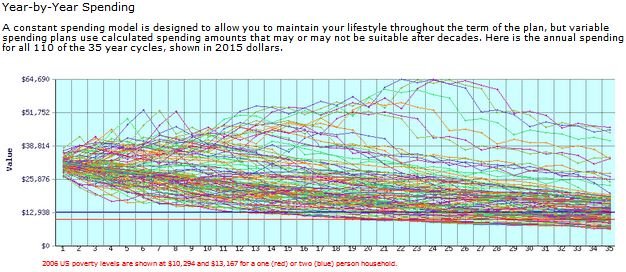

Scenario 4: Maybe the 4% withdrawal rate of Scenario 3 is attractive, but the idea of having 50% in stocks isn't. How would things have worked out with the same 4% variable withdrawal rate (and using the "95% rule") with the entire portfolio invested in 5 Year treasuries (as in Scenario 1)? Here's the chart of annual withdrawals:

Hmm. The general path of the lines is a lot different from Scenario 3, with annual withdrawals generally declining. Yes, those Treasuries had low annual volatility and were very "safe", but a retiree using only treasuries and needing to take 4% per year would generally have faced a hit in the real spending power of their annual withdrawals. The Treasuries just haven't generated sufficient returns. A look at the annual balances tells the tale. The average ending portfolio value was $385K, [FONT="]l[/FONT]ess than half the starting value[FONT="].[/FONT]

That's probably enough to give you an idea of how the program works. I'm far from an expert in FIRECalc, but there are plenty of people here who are, and who can answer any questions you might have. Finally, keep in mind that the data in FIRECalc is [FONT="]largely for the US[FONT="] and the most detailed data for [FONT="]asset classes begins in 1927. This is [FONT="]a [FONT="]period of[FONT="] prosperity i[FONT="]n the US, and the US was the most prosperous economy in the world over much of this span. So, [FONT="]some p[FONT="]eople [FONT="]might urge caution when using the data to build plans for the future. Still, [FONT="]a tool like this at least gives you something to use as a starting point. [FONT="]And, if you want, there are ways to "trick[FONT="]"[/FONT] FIRECalc if you want to see the impact of returns that were a few percentage points less than they have been historicall[FONT="]y. Enjoy.[/FONT][/FONT][/FONT][/FONT][/FONT][/FONT][/FONT][/FONT][/FONT][/FONT][/FONT][/FONT][/FONT]

[/FONT]

[FONT="]

Can you remind me what portfolio(s) you favor?

Not to be a wiseacre, but I favor everyone building a portfolio that suits their needs. [FONT="]My personal portfolio has a high stock allocation ([FONT="]85+ %)[FONT="], and the stocks in it are slightly tilted to value stocks[FONT="]. We have a higher-th[FONT="]an-market weighting to small cap stocks, too. So, it's "Swedrow-esqe[FONT="]", but far [FONT="]less radical than [FONT="]his "only small and value" proposal. [/FONT] [/FONT][/FONT]Our [FONT="]withdrawals will be made using a[FONT="] "per[FONT="]cent of [/FONT]end-of-year balance" method. [FONT="]But [FONT="]that fits our requirements, and it might be a very bad choice for someone else[FONT="].[/FONT][/FONT][/FONT][/FONT][/FONT][/FONT][/FONT][/FONT][/FONT][/FONT]

[/FONT]