RonBoyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

You are all aware that FIRECalc uses actual history, not Monte Carlo simulations, right?

FIRECalc: How it Works

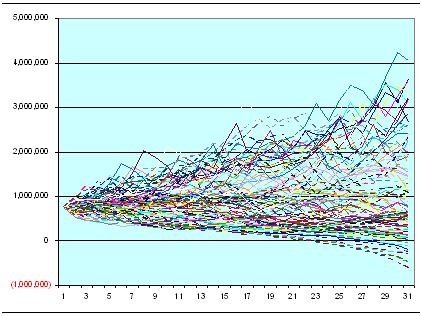

Okay, my wheels seem to have come off the track again. The chart at that link looks suspiciously like it was "Monte Carlo" generated:

I know that MC is not mentioned in the link but what exactly does "uses actual history" mean and how, then, is it used to sniff out future scenarios?