The estate tax seems like a pretty effective wealth tax, without the retirement problems a yearly tax would create. Never seemed fair to me, but it seems better than a 1%/year wealth tax. What a PITA to have to figure something like that every year. It's bad enough trying to cope with the estate tax for that matter. I've spent more creating our revokable trust that I have spent cumulatively on Turbo Tax. I'd like something simple.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

wealth tax

- Thread starter smjsl

- Start date

- Status

- Not open for further replies.

M Paquette

Moderator Emeritus

Do I understand him correctly?

Let's tax accumulated wealth after the fact (punish savers & investors and progressively reward consumption) vs modifying tax code so people know the rules going forward - both of which can reduce wealth/income inequality. Dodges will be possible in either case.

Aren't we still suffering from the worst recession in 80 years in which over consumption/leverage played a substantial role?

Yup. That's the economic risk of a wealth tax. Most places that have such a tax use fairly high thresholds and progressive rates to try and avoid the worst of this.

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Is that ham I smell? No, it's bacon...comment withdrawn.

Last edited:

Um. Not so much. Khufu has a point, and has identified one of the factors involved. There are others... His point is ideologically unacceptable to many folks, and probably not worth discussing here at the risk of bacon on the hoof appearing.

I am a big fan of maple smoked bacon, though...

I'm partial to hickory smoked, myself.

nun

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2006

- Messages

- 4,872

Something else that might be on the table in the tax reforms is FICA. I'd remove the phase out of the tax above a certain income level, and you might argue for a progressive FICA tax. I'd combine that with an increase in the starting age for SS and Medicare for those currently under 55. Maybe a year for those between 40 and 55 and a couple for those younger.

The costs of Medicare and Medicaid also need to be addressed to bring them closer to those in other developed nations. There's no reason (other than vested ones) that the US should spend twice as much per capita on health care as other nations. US residents get a really raw deal when it comes to health care.

The costs of Medicare and Medicaid also need to be addressed to bring them closer to those in other developed nations. There's no reason (other than vested ones) that the US should spend twice as much per capita on health care as other nations. US residents get a really raw deal when it comes to health care.

Last edited:

. . . <Para. Snip>

* * * <another Para. Snip>

One problem with progressive income tax: One year I had a very large cap gain (poor tax planning on my part). I was taxed like I was a rich person, yet, I spent no more that year than any other. I knew I wasn't rich - it was just a timing thing. So why am I taxed the same as someone who makes that $$$ every year? The same can be said of people in very volatile businesses, maybe they have one good year out of three, and they plan accordingly? Not fair, I say.

-ERD50

Did anyone else have the opportunity to employ income averaging back in the day? It was designed to deal with this very issue. We used it when we were just starting out, but I believe it was axed in '86 as part of the base broadening/rate decrease. Needless to say, it hasn't come back as much of that law was undercut over the years.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Did anyone else have the opportunity to employ income averaging back in the day? It was designed to deal with this very issue. We used it when we were just starting out, but I believe it was axed in '86 as part of the base broadening/rate decrease. Needless to say, it hasn't come back as much of that law was undercut over the years.

AFAIK, income averaging is very restricted these days. Farmers, I think, can use it - and military according to last post.

But pre-1986, my income was just on an even, steady rise. Averaging would not have applied.

-ERD50

Yup. That's the economic risk of a wealth tax. Most places that have such a tax use fairly high thresholds and progressive rates to try and avoid the worst of this.

That's right. The threshold matters a lot. While everyone here who has been saving for retirement imagines his lifetime savings being looted for the benefit of people who can't pay their credit card bills, the issue at hand is quite different. Consider the case of Michael Bloomberg, the mayor of NYC. When he became mayor about 10 years ago he was worth two or three billion dollars. At the time of the financial crisis I noticed with interest that the estimate of his wealth had risen to eleven billion dollars. The most recent estimate I have seen is that he is now worth twenty-five billion dollars. That's a truly extraordinary and, in fact, excessive rate of wealth accumulation. Bloomberg benefited from the Bush tax cuts, the preferential tax rates on investment income, and the income cap on the payroll tax among many other systematic rewards for the rich from the tax system. Bloomberg is not an outlier, at least not among the 1%.

So, in my opinion clawing some of that back through a wealth tax would be a worthy policy goal, both for the revenue itself and also to reduce the current level of inequality in the US which is threatening the foundations of democracy. Bloomberg, for instance, by using his money got the city council to modify the city charter to permit him to run for a third mayoral term. He didn't bribe politicians, which is illegal, but he did make contributions to many non-profit organizations in the city who then publicly supported his campaign.

The concentration of wealth threatens the American consumer economy as well, since people like Bloomberg can't spend it fast enough to keep the economy going. But politically I don't see a wealth tax going anywhere. I think raising income tax rates is a better idea along with reducing or eliminating preferential rates on investment income and eliminating the payroll tax cap, for starters.

Something else that might be on the table in the tax reforms is FICA. I'd remove the phase out of the tax above a certain income level, and you might argue for a progressive FICA tax. I'd combine that with an increase in the starting age for SS and Medicare for those currently under 55. Maybe a year for those between 40 and 55 and a couple for those younger.

The problem with an across the board increase in SS retirement age is that longevity gains among retirees have themselves been regressive, i.e. most of the increase in longevity have gone to the upper income group. The lower half of the working population by income have seen only a small increase. So, that means that increasing the SS retirement age would have a serious adverse effect on the group that does the physical labor which is harder to keep doing when older, depends more on SS for retirement funding, and has little or no other resources to replace SS. It would be very unfair.

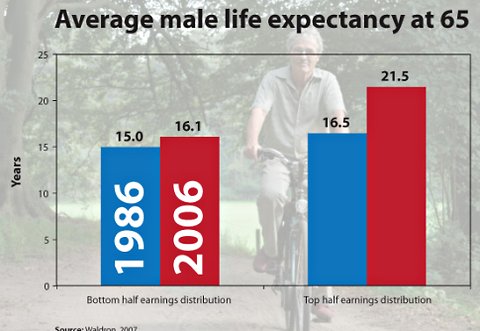

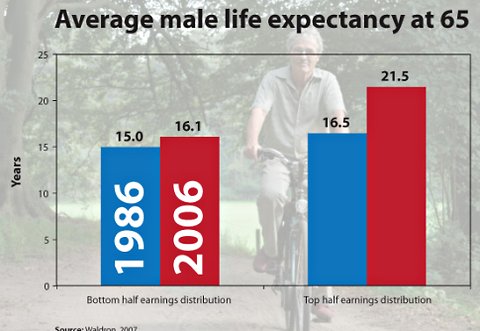

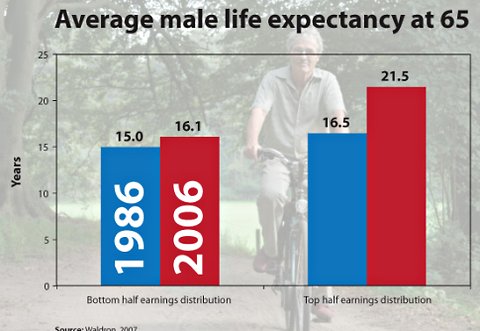

This graph from Krugman makes the difference clear.

An ""excessive rate of wealth accumulation." That's a finely-tuned knack you've got there for identifying who should be able to keep their property.The most recent estimate I have seen is that he is now worth twenty-five billion dollars. That's a truly extraordinary and, in fact, excessive rate of wealth accumulation.

First--individuals retire, groups don't. Some high-earners do hard physical labor, most low-earners probably do not. So we're lumping a bunch of stuff into one pot. Next, maybe Mr Krugman would provide us with a graph of "return on SS premiums paid" for the upper income group and the lower income group. Don't hold your breath for that one, because we both know what it will show. Finally, in the graph above, while you see a growing disparity between income levels, I note that all groups are living longer than retirees of similar income levels in 1986, so everyone is getting a better deal than they would have in 1986. Was it "unfair" then? Is it sustainable now?The problem with an across the board increase in SS retirement age is that longevity gains among retirees have themselves been regressive, i.e. most of the increase in longevity have gone to the upper income group. The lower half of the working population by income have seen only a small increase. So, that means that increasing the SS retirement age would have a serious adverse effect on the group that does the physical labor which is harder to keep doing when older, depends more on SS for retirement funding, and has little or no other resources to replace SS. It would be very unfair.

This graph from Krugman makes the difference clear.

If you favor a SS retirement age graduated by income level due to differing life expectancy, you should certainly favor one based on gender (women should work longer). And race--even when decoupled from income--is a highly significant factor in life expectancy, so don't neglect a separate adjustment for that. Smokers should certainly begin getting their SS checks significantly earlier.

In some measure, "fairness" consists of establishing rules and keeping them relatively constant so people can plan their lives.

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It is interesting that in 1986 life expectancy was so similar and it is so dissimilar only 20 years later. Did the author speculate as to why?

If it was due to things beyond their control then I think you have a point on unfairness. However, if it is due to issues within their control, then I would be less sympathetic.

If it was due to things beyond their control then I think you have a point on unfairness. However, if it is due to issues within their control, then I would be less sympathetic.

M Paquette

Moderator Emeritus

It is interesting that in 1986 life expectancy was so similar and it is so dissimilar only 20 years later. Did the author speculate as to why?

If it was due to things beyond their control then I think you have a point on unfairness. However, if it is due to issues within their control, then I would be less sympathetic.

Poor people with low levels of education are least likely to seek preventive healthcare or routine care for minor problems. High income earners are more likely to seek care, and those with higher levels of education in particular are most likely to seek preventive care. This seems to have a longer term impact.

It's something to bear in mind for those electing to follow an impoverished lifestyle choice.

http://www.cdc.gov/nchs/

Last edited:

An ""excessive rate of wealth accumulation." That's a finely-tuned knack you've got there for identifying who should be able to keep their property.

It may be news to you, but all questions of taxation policy are questions of who should be able to keep his property.

nun

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2006

- Messages

- 4,872

The problem with an across the board increase in SS retirement age is that longevity gains among retirees have themselves been regressive, i.e. most of the increase in longevity have gone to the upper income group. The lower half of the working population by income have seen only a small increase. So, that means that increasing the SS retirement age would have a serious adverse effect on the group that does the physical labor which is harder to keep doing when older, depends more on SS for retirement funding, and has little or no other resources to replace SS. It would be very unfair.

This graph from Krugman makes the difference clear.

As samclem says individuals retire, not groups and I'd hate to see different SS ages for different "groups". Far better to have a progressive FICA tax. The SS benefit is already progressive, but maybe it should be made independent of your earnings history like in the UK where everyone is going to get the same state pension irrespective of what they put in as long as they have 30 years of contributions. This means the low waged will see a big rise in their pension and higher earners will see it fall. The goal is to provide a livable pension for everyone. The UK is also introducing mandatory retirement savings in either DB or 401k type plans

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,427

The most recent estimate I have seen is that he is now worth twenty-five billion dollars. That's a truly extraordinary and, in fact, excessive rate of wealth accumulation.

Please sir/madam: By what authority do you claim to determine what is "in fact, excessive rate of wealth accumulation".

"In fact"? What fact defines what is excessive? Please, what fact? Is there a rule I missed that says five million is ok, but six million is not?

C'mon! I will agree it is extraordinary, but who says (beyond yourself) what is or isn't too much? Sez who?!

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Poor people with low levels of education are least likely to seek preventive healthcare or routine care for minor problems. High income earners are more likely to seek care, and those with higher levels of education in particular are most likely to seek preventive care. This seems to have a longer term impact.

It's something to bear in mind for those electing to follow an impoverished lifestyle choice.

CDC - National Center for Health Statistics

I suspect that you are right and another part is that the poor smoke more than those of means. I guess my point is that the difference in mortality improvements are due to things that are within their control and a result of their poor decisions, so I don't have much sympathy for them. If they reduced smoking they would be both healthier and wealthier. Most insurance plans have no cost preventative care so there is no excuse there.

Please sir/madam: By what authority do you claim to determine what is "in fact, excessive rate of wealth accumulation".

"In fact"? What fact defines what is excessive? Please, what fact? Is there a rule I missed that says five million is ok, but six million is not?

C'mon! I will agree it is extraordinary, but who says (beyond yourself) what is or isn't too much? Sez who?!

I was floored by the statement of excessiveness as if it were fact rather than opinion.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

First--individuals retire, groups don't. Some high-earners do hard physical labor, most low-earners probably do not. So we're lumping a bunch of stuff into one pot. Next, maybe Mr Krugman would provide us with a graph of "return on SS premiums paid" for the upper income group and the lower income group. Don't hold your breath for that one, because we both know what it will show. Finally, in the graph above, while you see a growing disparity between income levels, I note that all groups are living longer than retirees of similar income levels in 1986, so everyone is getting a better deal than they would have in 1986. Was it "unfair" then? Is it sustainable now?

If you favor a SS retirement age graduated by income level due to differing life expectancy, you should certainly favor one based on gender (women should work longer). And race--even when decoupled from income--is a highly significant factor in life expectancy, so don't neglect a separate adjustment for that. Smokers should certainly begin getting their SS checks significantly earlier.

In some measure, "fairness" consists of establishing rules and keeping them relatively constant so people can plan their lives.

Good point, Samclem. Because SS is mostly a progressive wage income replacement program (wisely only up to the wage/benefit cap), it replaces a greater pecentage of wage income for lower wage earners than it does for higher wage income earners. What I would like to see, from Krugman or someone else, is a chart or graph which shows which effect dominates in SS overall: lower wage income earners getting a higher percentage of their wage income replaced by SS or higher wage income earners simply living longer.

As to a wealth tax, I feel it would punish savers. That being said, I am fine with an estate tax because it is a tax on the transfer of wealth from one person to another which to me is simply another form of passive income to the recipient.

The local property tax is a flawed type of wealth tax because it taxes the full value of the property even if the owner has a mortgage on it. If we wanted it to be a truer wealth tax then it would be based only on the equity portion of the property owned by the owner. Does this mean anyone who is "underwater" on their mortgage should at least escape paying property taxes if not receive a refund on their negative equity? Not sure. [Using the local property tax to fund public schools has additional problems because it does not take into account how many children, if any, come from each household, but that is another topic for another day.]

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

As samclem says individuals retire, not groups and I'd hate to see different SS ages for different "groups". Far better to have a progressive FICA tax. The SS benefit is already progressive, but maybe it should be made independent of your earnings history like in the UK where everyone is going to get the same state pension irrespective of what they put in as long as they have 30 years of contributions. This means the low waged will see a big rise in their pension and higher earners will see it fall. The goal is to provide a livable pension for everyone. The UK is also introducing mandatory retirement savings in either DB or 401k type plans

The SS you are describing is today's welfare program, one whose benefit is not based on wage income and one without any link, even a tenuous one, between FICA taxes paid in and benefits received. Are we as a country prepared to transform SS into another welfare program. I don't think so and I surely hope not!

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yes, but getting back to the OP, this thread was about changing our tax code and taxing wealth (long) after the fact. It's one thing to discuss thresholds going forward, and something else to establish same retroactively on wealth that has already been taxed once or more (however imperfectly). The implications going forward associated with such a change are huge, a "leveling" that would also reduce the average wealth considerably in time...that hurts everyone in the long run.It may be news to you, but all questions of taxation policy are questions of who should be able to keep his property.

Independent

Thinks s/he gets paid by the post

- Joined

- Oct 28, 2006

- Messages

- 4,629

Nobody has mentioned the thing that struck me most in the OP -

A tax that looks pretty modest (0% thru $500k, 1% on the next $500k, 2% thereafter)

would raise as much money as the current individual FIT plus the estate tax.

I wouldn't have expected that. It says a lot about the concentration of wealth in the US.

(and, yes I know that's a static calc and it would be hard to collect etc. It's just an interesting fact.)

A tax that looks pretty modest (0% thru $500k, 1% on the next $500k, 2% thereafter)

would raise as much money as the current individual FIT plus the estate tax.

I wouldn't have expected that. It says a lot about the concentration of wealth in the US.

(and, yes I know that's a static calc and it would be hard to collect etc. It's just an interesting fact.)

Independent

Thinks s/he gets paid by the post

- Joined

- Oct 28, 2006

- Messages

- 4,629

I can think of three "wealth" taxes in the US. Maybe "asset" tax is a more neutral word.

Clearly real estate taxes are a tax on one type of asset.

Income taxes collected on any type of investment income are an asset tax if the income tax does not have an inflation index (assuming there is some inflation).

Estate taxes can be viewed as and asset tax on the accumulated assets of an individual. Instead of paying 2% per year for n years, you pay 35% when you die.

(Of course, estate taxes can also be viewed as income taxes on the heir, since it's the heir that loses spending power. That discussion gets pretty political pretty fast.)

Clearly real estate taxes are a tax on one type of asset.

Income taxes collected on any type of investment income are an asset tax if the income tax does not have an inflation index (assuming there is some inflation).

Estate taxes can be viewed as and asset tax on the accumulated assets of an individual. Instead of paying 2% per year for n years, you pay 35% when you die.

(Of course, estate taxes can also be viewed as income taxes on the heir, since it's the heir that loses spending power. That discussion gets pretty political pretty fast.)

nun

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2006

- Messages

- 4,872

The SS you are describing is today's welfare program, one whose benefit is not based on wage income and one without any link, even a tenuous one, between FICA taxes paid in and benefits received. Are we as a country prepared to transform SS into another welfare program. I don't think so and I surely hope not!

Interestingly the new UK SS program I describe is being implemented by a right of center Conservative government. It is claimed that it will reduce overall costs and poverty by shifting the benefits to the lower waged.

The current US system is based on earnings, but the calculation of the SS benefit is progressive in that a low earner gets a bigger amount in proportion to their earnings than a high earner.....hence the existence of WEP

- Status

- Not open for further replies.

Similar threads

- Replies

- 5

- Views

- 729

- Replies

- 42

- Views

- 5K