side fund in lieu of pension from 57 to 65 = $500/mo * 12 * (65-57) = $48,000

side fund in lieu of SS from 57 to 67 = $2,600/mo *12 * (67-57) = $312,000

$2,000,000 - $48,000 - $312,000 = $1,640,000; * 3% WR = $49,200

$49,200 from long-term retirement portfolio + $31,200 from SS side fund/SS + $6,000 from pension side fund/pension = $86,400 spending at 3% WR

First 8 years withdrawals are $86,400/year... including $39,200 from side funds

Next two years withdrawals are $80,400/year... including $31,200 from SS side fund

After that, withdrawals are $49,200/year

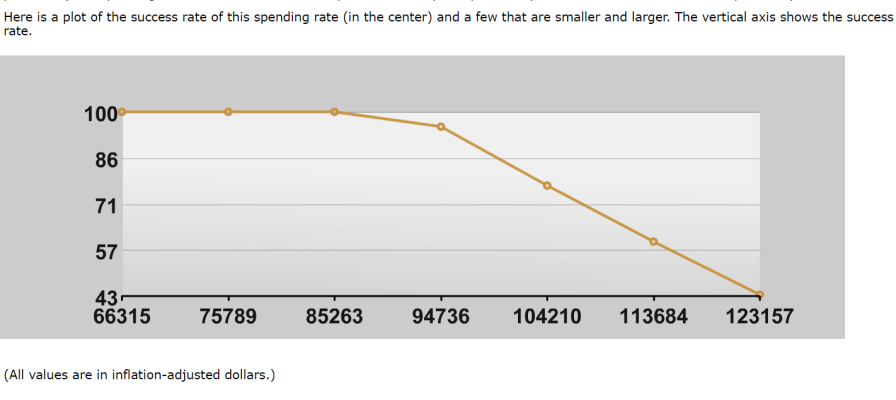

Put the $2 million, SS and pension into FIRECalc, 40 years and 60/40 AA it gets 100% success at $86,400 spending and a max spending at 95% success of $94,736... this is because you specified a 3% WR which is conservative... if you use a 3.5% WR the $86,400 becomes $94,600 right near the FIRECalc 95% success max spending.