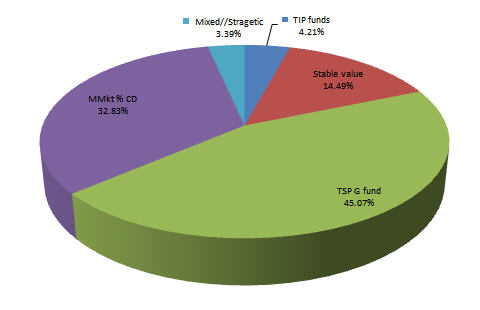

For non-equity, I own various REITs, vanguard's junk bond fund, and in my 401k vanguard's target retirement income fund, which has total us and foreign bond market index funds in it.

My 2014 Roth IRA contribution went into vanguard's junk bond fund. The rest of my Roth IRA is split between vanguard's us and foreign REIT indexes. Next year I may add vanguard's emerging market bond fund to my Roth IRA.

I felt like I had put as much into REITs as I wanted to for right now. So I wanted to put the 2014 Roth contribution into something that takes advantage of the tax protection and was decently priced. I'm not seeing any exceptionally good deals on anything. The junk bond fund seems descent enough. The bonds in the portfolio are not very junky and the duration is low. So I don't expect any interest rise to hit it too hard, and I don't think there will be many if any defaults on the loans.

I think the emerging markets bond fund is also a descent buy right now for my Roth. I may pick that one up next year.

My 401k is 100% vanguard's target retirement income fund and will probably stay that way. It was 100% total bond market index for a few years.

In my taxable account I have thought about adding MLPs but the tax complexity has kept me away so far. I'll probably buy some eventually. I don't think it would be that hard to deal with, I use turbotax.

I've also got a lot of cash in my taxable account. That's where all of my money has been going, except for 2014 Roth contribution, for the last 6 months or so. I plan to keep adding to cash until after taxes are done this year. I'm going to have a large tax bill this year.

All of my equity investments, outside the small allocation in the 401k target retirement income fund, are in my taxable account.