Prague

Recycles dryer sheets

- Joined

- Apr 20, 2017

- Messages

- 53

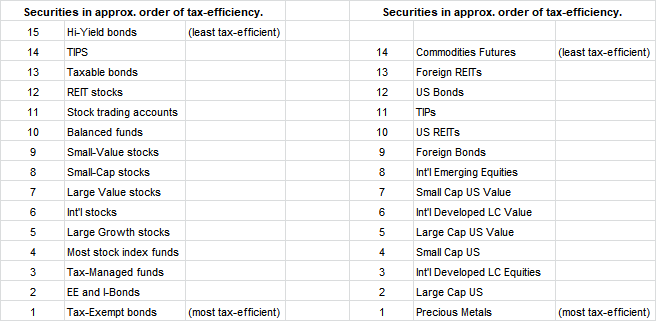

Years ago, I somehow learned that it is more tax efficient to put bond funds/income generation funds such as BIV, a bond index fund in the tax free account (ROTH) or tax deferred account (Traditional IRA) and put growth funds such as VOO, Vanguard version of the S&P 500 index fund in the taxable account.

However, a very financial savvy friend recently told me that he is doing just the opposite in his retirement. I am curious what approach is really correct or is it dependent on individual situation? If it depends, could you please provide your rationale for each approach?

In our case, we estimate that in our retirement, our tax bracket is going to be either 22% or 24%, but our effective tax rate has been anywhere between 17-19%. We are also in our early 50s and very close to ER but about 13 years away from being able to access income to be generated from our IRA accounts.

However, a very financial savvy friend recently told me that he is doing just the opposite in his retirement. I am curious what approach is really correct or is it dependent on individual situation? If it depends, could you please provide your rationale for each approach?

In our case, we estimate that in our retirement, our tax bracket is going to be either 22% or 24%, but our effective tax rate has been anywhere between 17-19%. We are also in our early 50s and very close to ER but about 13 years away from being able to access income to be generated from our IRA accounts.

Last edited: