The topic of this thread really interests me, as I plan to stay where I am (central city), and I expect that over time both rents and property prices in central but quality areas of attractive cities will increase faster than rents or property prices in general, even in those same cities. Eventually quality rapid transit may change this, but IMO it will be a long slow slog, and it will always be different to live in a nice leafy neighborhood 4-14 bocks from the business and retail core of a good city, and to live in a suburb, even in a nice suburb serviced by efficient transit.

The x factor in urban living is always- can and will the police suppress crime? That one will not go into a spreadsheet. But it takes a

good suburb indeed to lose crime today.

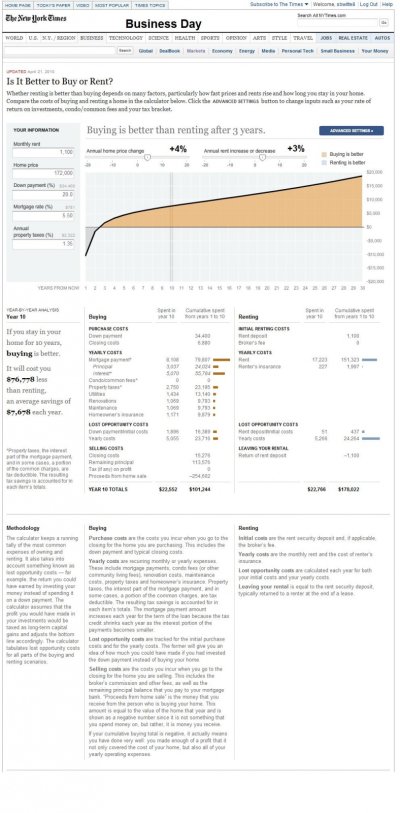

So, in spite of generally distrusting spreadsheets that try to lay out the future, I went geeky and made one with four separate growth factor variables: one for rents, one for property tax, one for HOA/condo fees, and one for bluechip equity dividend. I assumed a cash puchase, and for the apartment condition I invested the purchase price +closing costs into a small selection of quality equities with an estimated beginning yield set at 3%, and an 8% dividend growth rate. Equity price growth is ignored. I assumed RE tax and rents would both increase on average @ 5%, and HOA at @3%. All these factors are variables. For the rent condition, I set Y-0 at my current rent, which is about what the condo I am comparing to would rent at. If anything, my current rent is higher than what the condo in question might bring.

Then I increased each element by its chosen factor, and subtracted the costs other than PP of the condo from the rent at that same year. The exact path of this difference will vary depending on the growth factors, but in my chosen condition it is a small difference that slowly builds to a max at Y-10, then starts falling.

Since I assumed a cash purchase, income tax effects are limited to the untaxed value of the imputed rent. Pushing the other direction is the fact that I made no adjustments for maintenance or capital improvements on the bought condition, other than the HOA fee. These will be variable, but IMO perhaps a push.

Anyway, in this comparison buying is probably a slight winner, but with more risk and a higher hassle factor, over ten years or more. However, rather than increase its lead, buying loses ground relative to renting and investing the PP after about year 10.

Clearly this gets thrown out if rents skyrocket and dividend growth of quality companies stalls out, but that's spreadsheets.

Ha