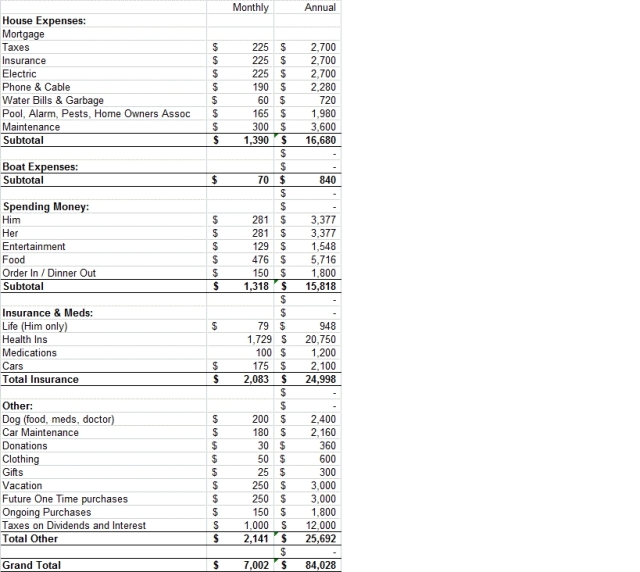

I am FI but still working, so some of my expenses are less because of work. We spend about 50K a year and I think that is high. From looking at your expenses, I notice we spend less on the following:

Taxes and Insurance (about 3500 less)

Electricity

Phone and Cable

HOA Pool etc. (no HOA or pool)

Taxes on Dividends etc.

Health Insurance (spend 15K less)

We spend at least 25K less on the items above, maybe more.

We spend more on the following items:

gifts

vacation

food (16 y.o. male living in our house)

I have been working to lower our monthly expenses on a long-term basis. We replaced our HVAC system along with all the ducting and we've seen a substantial savings in electric bills. We are also growing more veggies in our garden, which cuts down on food costs and gives us what I think are higher quality foods. We are now looking at replacing our toilets which will take us from 7 or 8 gallons a flush down to 1.3 gallons. I also installed low flow shower heads and we actually like them better than the old mega-flow shower heads. We replaced our water heater with a tankless water heater that heats only the water we need at the time. The shower heads and water heater were my efforts to combat my 16 year old's fondness of 30 minute showers. We have replaced a lot of light bulbs with those new funky energy saver bulbs. I also walk to work much more which saves on gas and I'm even foregoing purchasing my annual parking pass at work. I wanted to install a Franklin stove and burn wood for heat, but DW was against it for aesthetic reasons. I am still thinking of ways to reduce spending though.