My spouse's eyes glaze over when I start to talk about this stuff. Can I ask this group to help me check my math and assumptions? Thanks.

We are planning a 3% withdrawal rate over 50 years. Here are my assumptions (all figures present dollars before tax):

50%: Fixed income earns 3.5% (fixed income is in long-term munis at 5%, I and EE bonds at approximately 3.5%, taxable muni bond fund at 3.5%, total bonds in IRA at 2.5%, and "cash" at 1% or so.) Taking 3% leaves .5% for inflation.

50% Stocks: I need stocks to earn an extra 5.5% per year in order to give the stock half of my portfolio enough of a bounce to come up with an extra overall portfolio 3% for inflation each year. As a result, my stocks need to earn 3% for withdrawal, plus an extra 5.5% for a total of 8.5%.

The .5% extra from the 50% in fixed income plus the 5.5% extra from the 50% in stocks gives me 3% extra for the entire portfolio to cover inflation. Am I getting this right?

Needing to average 8.5% on stocks has me concerned. I probably shouldn't be concerned because our existing budget is just a hair above 2%. Therefore, a 2.5% budget would give us a nice cushion. At a 2.5% withdrawal rate, my math looks like this:

50% in fixed income earns 3.5% leaving an extra 1%.

50% in stocks needs 2.5% plus 5% for a total of 7.5%

I'm more comfortable knowing I've covered withdrawals and inflation at 2.5% with a 7.5% stock return.

On the other hand, I wonder if 2.5% is unnecessarily skimpy. If I just take out 3%/year which was my plan, I take out more after good years and less after bad. Because my budget is closer to 2%, absorbing the variations should present zero problems. In fact, I suspect that we'd actually have a hard time spending the full 3% anyway. Habits die hard.

Anyway, thanks for "listening" and hopefully not glazing over. Any thoughts or corrections most welcome.

SDFIRE

We are planning a 3% withdrawal rate over 50 years. Here are my assumptions (all figures present dollars before tax):

50%: Fixed income earns 3.5% (fixed income is in long-term munis at 5%, I and EE bonds at approximately 3.5%, taxable muni bond fund at 3.5%, total bonds in IRA at 2.5%, and "cash" at 1% or so.) Taking 3% leaves .5% for inflation.

50% Stocks: I need stocks to earn an extra 5.5% per year in order to give the stock half of my portfolio enough of a bounce to come up with an extra overall portfolio 3% for inflation each year. As a result, my stocks need to earn 3% for withdrawal, plus an extra 5.5% for a total of 8.5%.

The .5% extra from the 50% in fixed income plus the 5.5% extra from the 50% in stocks gives me 3% extra for the entire portfolio to cover inflation. Am I getting this right?

Needing to average 8.5% on stocks has me concerned. I probably shouldn't be concerned because our existing budget is just a hair above 2%. Therefore, a 2.5% budget would give us a nice cushion. At a 2.5% withdrawal rate, my math looks like this:

50% in fixed income earns 3.5% leaving an extra 1%.

50% in stocks needs 2.5% plus 5% for a total of 7.5%

I'm more comfortable knowing I've covered withdrawals and inflation at 2.5% with a 7.5% stock return.

On the other hand, I wonder if 2.5% is unnecessarily skimpy. If I just take out 3%/year which was my plan, I take out more after good years and less after bad. Because my budget is closer to 2%, absorbing the variations should present zero problems. In fact, I suspect that we'd actually have a hard time spending the full 3% anyway. Habits die hard.

Anyway, thanks for "listening" and hopefully not glazing over. Any thoughts or corrections most welcome.

SDFIRE

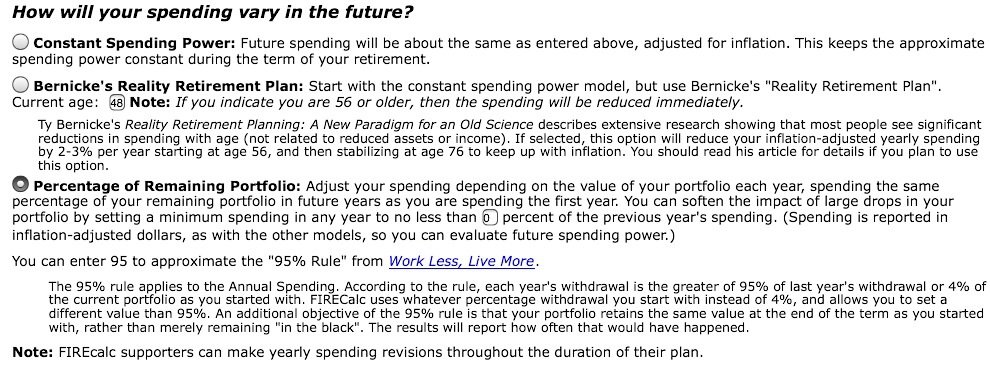

This very valuable tool allows me to see the value of my portfolio over time as well as the inflation adjusted portfolio value. Just exactly what I was looking for. Now, my only remaining question is how I can tell firecalc to assume a 3.5% fixed income return combined with a total market return for the stock portion using historic stock values?

This very valuable tool allows me to see the value of my portfolio over time as well as the inflation adjusted portfolio value. Just exactly what I was looking for. Now, my only remaining question is how I can tell firecalc to assume a 3.5% fixed income return combined with a total market return for the stock portion using historic stock values?