Whisper66: It's always very interesting to me the different perspectives we all have on our economy.

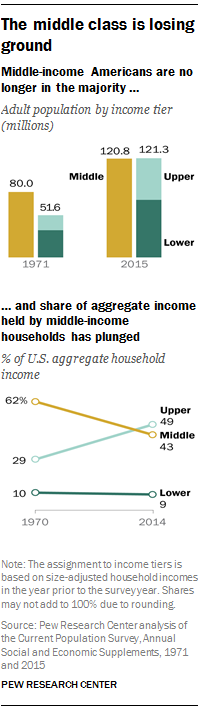

I wish the positive thinkers are correct yet what worries many others that our trade deficit is huge and it is like this for a very long time, as we need to pay off the dis-balance we borrow and print money ($US is still main reserve currency in the world but other countries understand how it works), our largest ever in the world history Debt continue to grow with budget deficit as well and middle class (the back bone of every great society) is shrinking. Is not it is something to worry about?

I wish the positive thinkers are correct yet what worries many others that our trade deficit is huge and it is like this for a very long time, as we need to pay off the dis-balance we borrow and print money ($US is still main reserve currency in the world but other countries understand how it works), our largest ever in the world history Debt continue to grow with budget deficit as well and middle class (the back bone of every great society) is shrinking. Is not it is something to worry about?